Last update images today Apple Earnings: Unveiling The Tech Giants Performance

Apple Earnings: Unveiling the Tech Giant's Performance

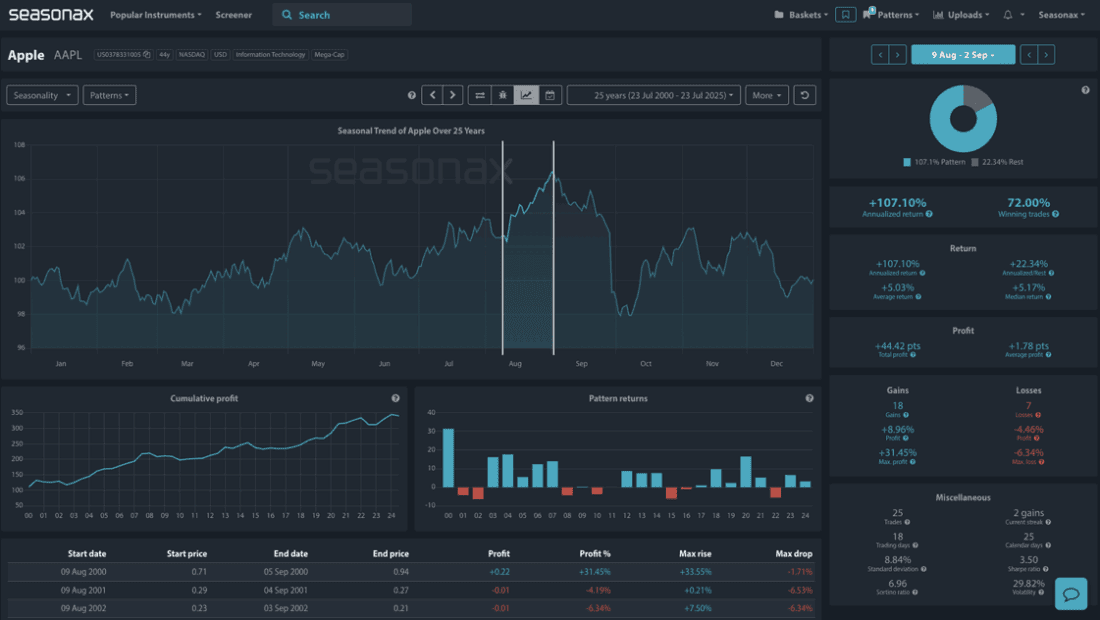

The anticipation surrounding Apple's earnings releases is always palpable, turning the financial world's attention to Cupertino. This week, as Apple unveils its latest financial results, understanding the key indicators and potential impact is crucial for investors, analysts, and even casual observers of the tech landscape. Let's delve into what to expect from Apple's earnings and what it all means.

Understanding Apple Earnings: The Basics

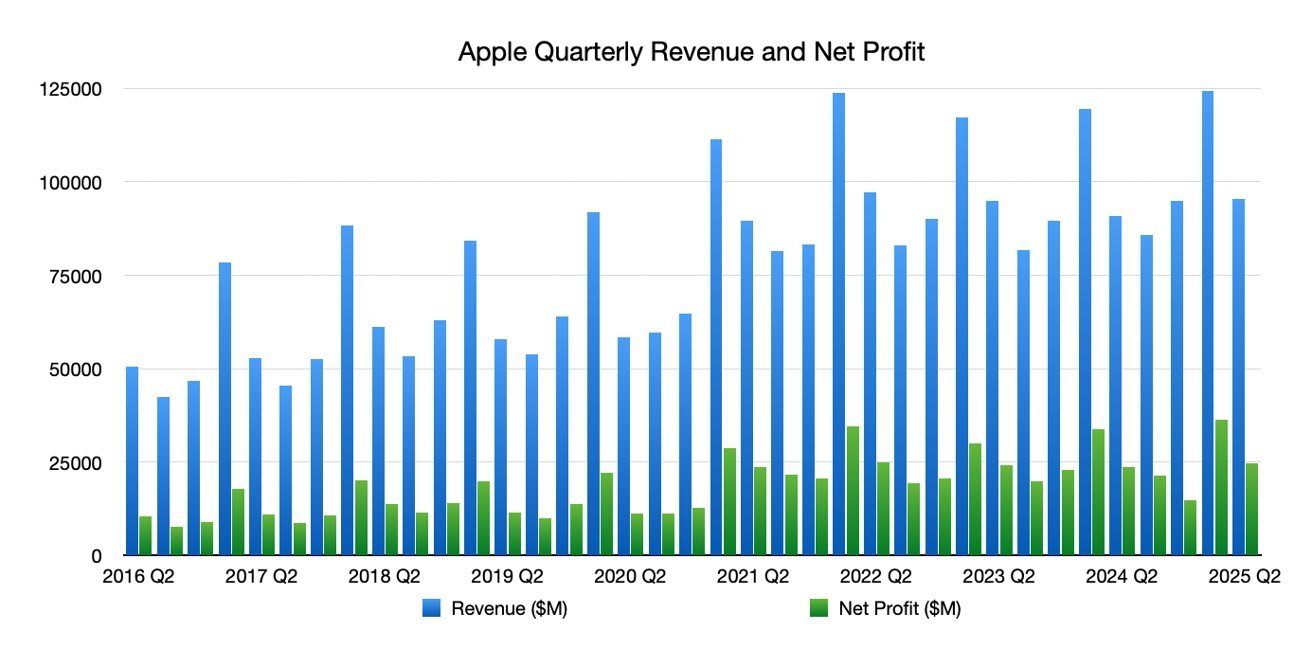

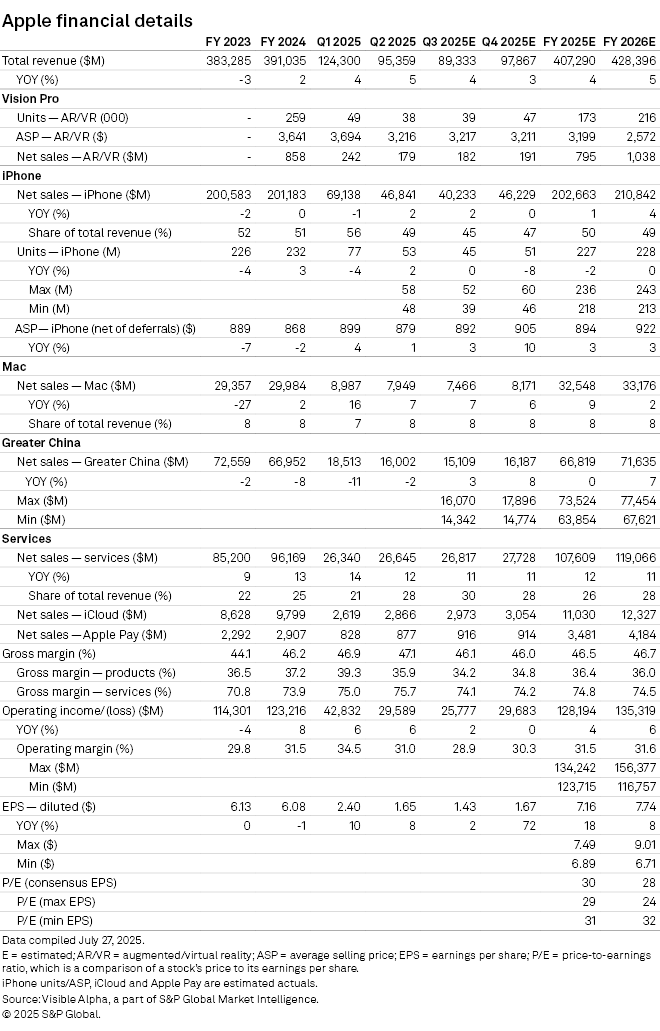

Apple Earnings reports provide a snapshot of the company's financial health over a specific period, typically a quarter. Key metrics include revenue, net income, earnings per share (EPS), and gross margin. These figures are compared to the same period in the previous year and analyst estimates to gauge Apple's performance. Exceeding expectations often leads to a surge in the stock price, while falling short can trigger a decline. The reported Apple Earnings offer insights into the company's ability to generate profits from its sales of iPhones, iPads, Macs, wearables, and services.

Decoding the Numbers: Key Metrics in Apple Earnings

When the Apple Earnings report hits the headlines, dissecting the numbers becomes essential.

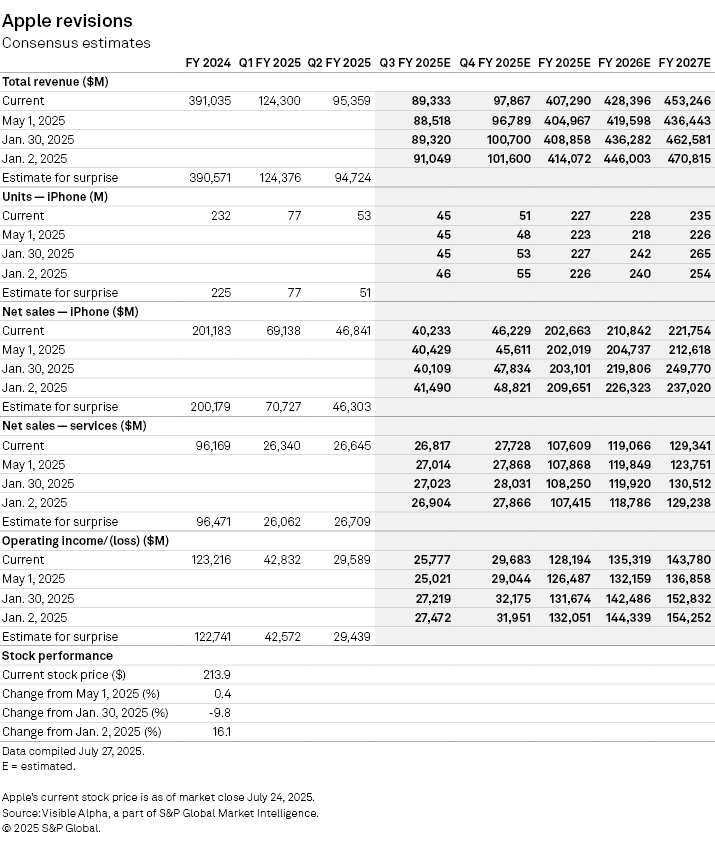

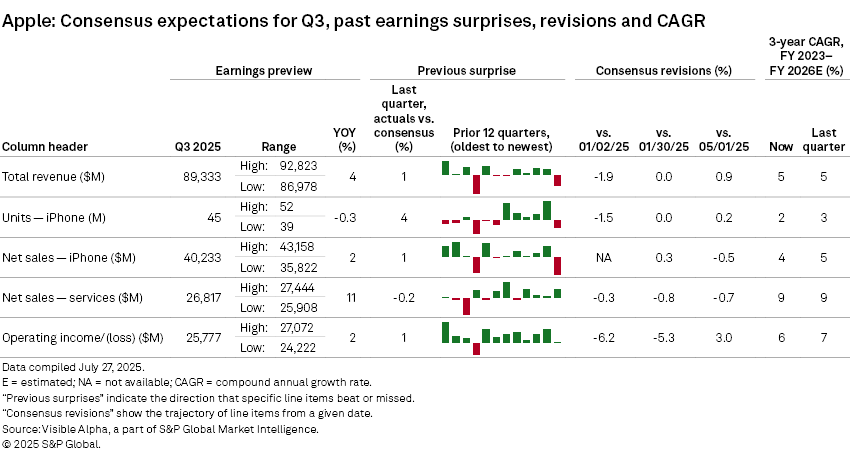

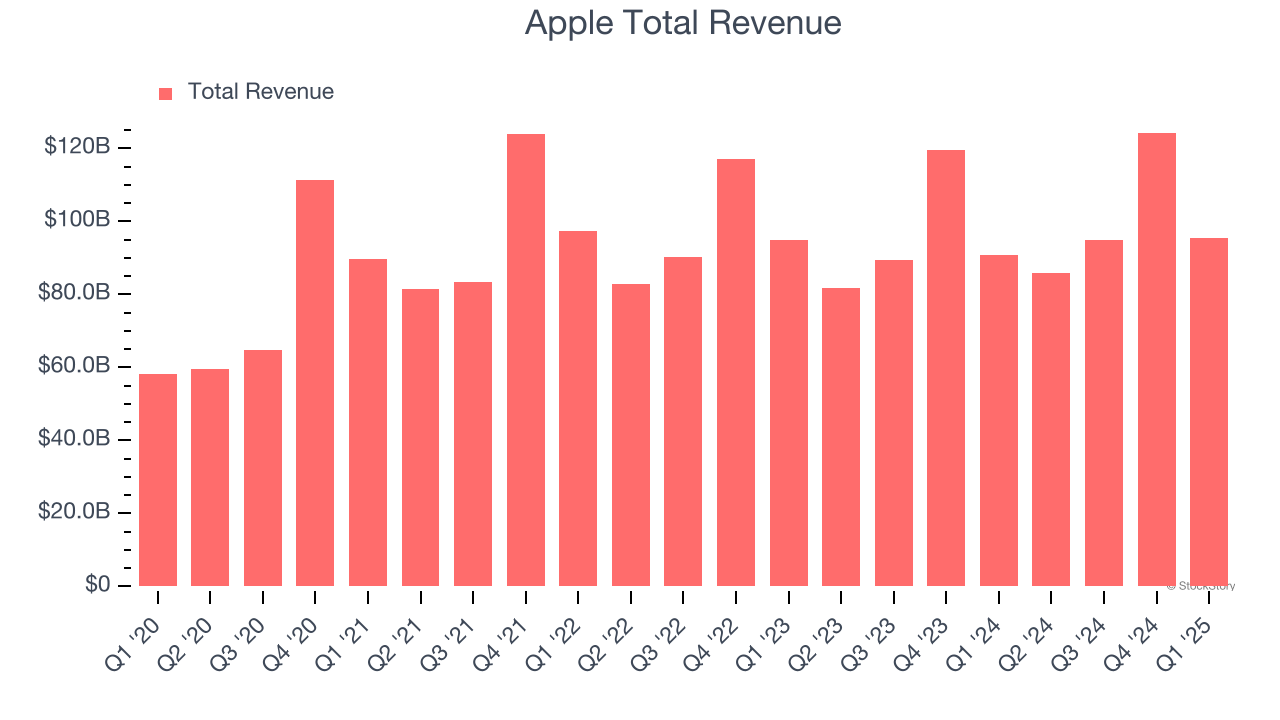

- Revenue: This indicates the total amount of money Apple generated from its sales. Analyzing revenue growth provides a clear picture of demand for Apple's products and services. Look for trends and whether revenue growth is accelerating, decelerating, or stagnant.

- Earnings Per Share (EPS): EPS represents the company's profit allocated to each outstanding share of stock. It's a critical metric for investors, reflecting profitability on a per-share basis. A higher EPS generally translates to a more profitable company.

- Gross Margin: This measures the percentage of revenue remaining after deducting the cost of goods sold. A high gross margin indicates efficient production and pricing strategies. Tracking changes in gross margin can highlight shifts in Apple's cost structure or pricing power.

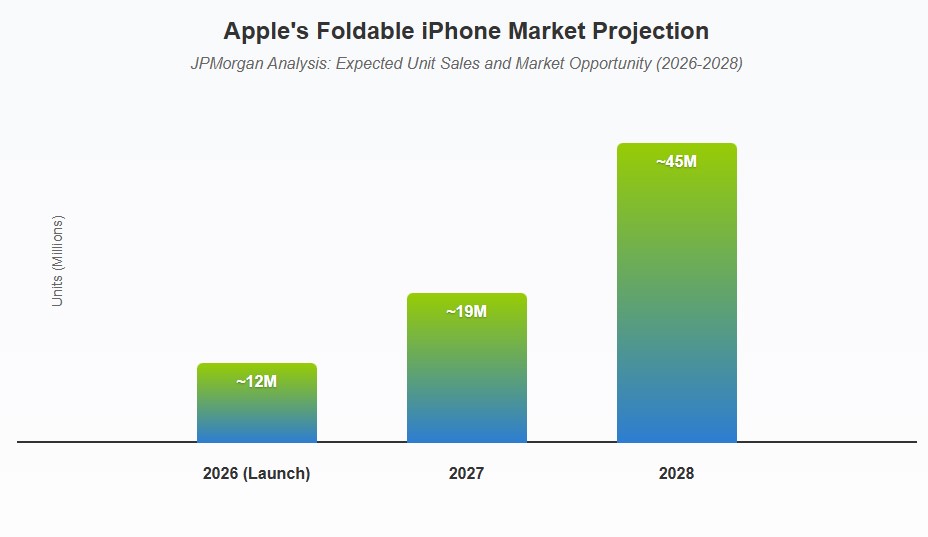

- Product-Specific Performance: Pay close attention to the performance of individual product categories like iPhones, Macs, iPads, and Wearables. Strong iPhone sales are often a significant driver of overall revenue, while growth in other areas indicates diversification and potential future growth engines. Analyzing Apple Earnings by product category gives valuable insights.

- Services Revenue: Apple's services segment, which includes Apple Music, iCloud, Apple TV+, and the App Store, has become increasingly important. Monitor the growth rate of services revenue, as it provides a recurring revenue stream and contributes to higher margins. Services revenue growth reflects the strength of Apple's ecosystem and its ability to monetize its user base.

The iPhone Effect: How It Impacts Apple Earnings

The iPhone remains Apple's flagship product and a primary driver of its revenue. The success of new iPhone models significantly impacts Apple Earnings. Factors to consider include:

- Unit Sales: The number of iPhones sold during the quarter.

- Average Selling Price (ASP): The average price at which iPhones are sold. Higher ASPs can boost revenue, even if unit sales remain flat.

- Market Share: Apple's iPhone market share compared to competitors like Samsung and Google.

- Geographical Performance: iPhone sales in key markets like China, the United States, and Europe.

A strong iPhone performance typically translates to positive Apple Earnings results and vice versa. Investors closely scrutinize iPhone sales data to gauge consumer demand and Apple's competitive position.

Beyond Products: The Rising Significance of Apple's Services

Apple's services segment is becoming an increasingly crucial component of its overall financial performance. Services include:

- Apple Music: The subscription-based music streaming service.

- iCloud: Apple's cloud storage and backup service.

- Apple TV+: The video streaming service.

- App Store: The platform for downloading and purchasing apps.

- Apple Pay: The mobile payment system.

Growth in these services contributes to recurring revenue and higher profit margins. Strong services revenue can help offset potential declines in hardware sales. Analyzing Apple Earnings reveals the growing importance of these services.

The Macroeconomic Landscape: External Factors Influencing Apple Earnings

Apple, like all global corporations, is influenced by macroeconomic factors:

- Economic Growth: A strong global economy typically leads to higher consumer spending and increased demand for Apple products.

- Currency Exchange Rates: Fluctuations in exchange rates can impact Apple's revenue and profitability, especially in international markets.

- Supply Chain Disruptions: Disruptions to the global supply chain can affect Apple's ability to manufacture and deliver products.

- Inflation: Rising inflation can impact consumer spending and potentially decrease demand for discretionary items like Apple products.

Understanding these macroeconomic trends is essential for interpreting Apple Earnings in context.

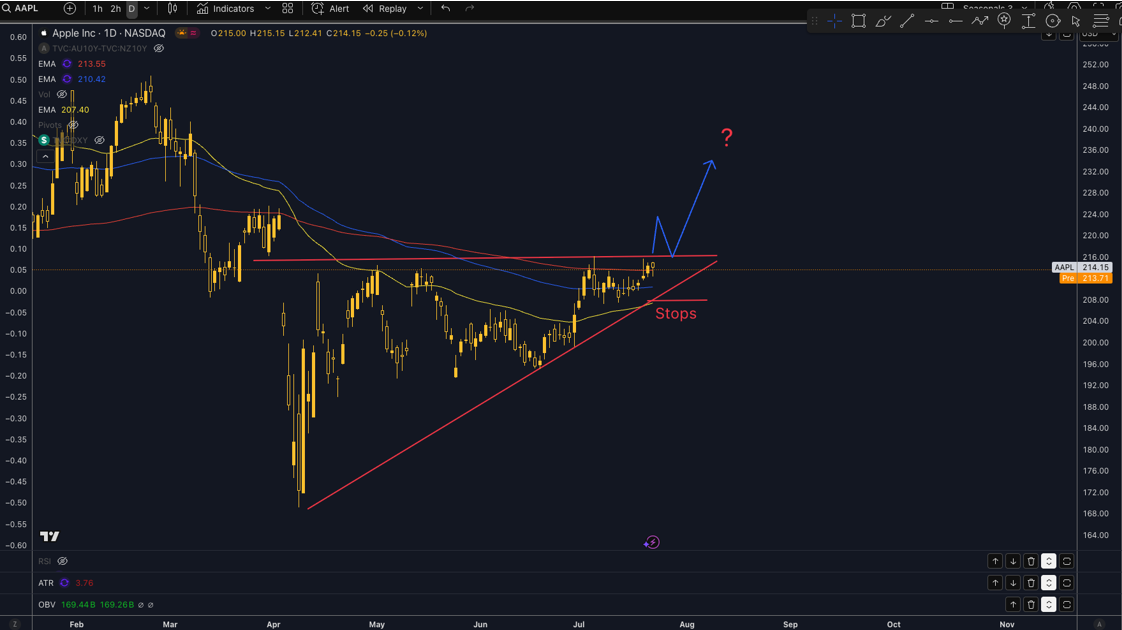

The Future Outlook: Guidance and Analyst Expectations Regarding Apple Earnings

Apple's management provides guidance for the upcoming quarter during the earnings call. This guidance includes expectations for revenue, gross margin, and operating expenses. Analyst expectations also play a significant role in shaping market sentiment. If Apple's guidance or actual results fall short of analyst expectations, the stock price may decline. Conversely, exceeding expectations can lead to a rally. The upcoming Apple Earnings release will be closely watched for management's outlook on future performance.

Potential Surprises: What to Watch Out For in Apple Earnings

While analysts make predictions and Apple offers guidance, surprises can still occur. These could include:

- Unexpected product launches: New products or services not previously announced.

- Major partnerships: Collaborations with other companies that could boost revenue.

- Acquisitions: The purchase of another company that could expand Apple's offerings.

- Regulatory changes: Government regulations that could impact Apple's business.

Keeping an eye out for these potential surprises can provide a deeper understanding of the Apple Earnings report and its implications.

The Impact on Investors: What Apple Earnings Mean for Your Portfolio

Apple Earnings releases can have a significant impact on investor portfolios. A positive earnings report can lead to an increase in the stock price, boosting returns for shareholders. Conversely, a negative report can cause the stock price to decline, resulting in losses. Investors should carefully analyze the earnings report and consider their investment objectives and risk tolerance before making any decisions. Long-term investors may choose to hold their shares, while short-term traders may look to capitalize on the volatility surrounding the earnings release. Paying attention to Apple Earnings is crucial for informed investing.

Apple Earnings: Question and Answer

Q: What are the key metrics to watch in Apple's earnings report?

A: Revenue, Earnings Per Share (EPS), Gross Margin, product-specific performance (iPhone, Mac, iPad, Wearables), and services revenue.

Q: How does iPhone sales impact Apple's earnings?

A: The iPhone is Apple's flagship product; strong iPhone sales typically translate to positive earnings.

Q: What is the significance of Apple's services segment?

A: The services segment provides recurring revenue and higher profit margins, contributing to overall financial performance.

Q: What external factors can influence Apple's earnings?

A: Economic growth, currency exchange rates, supply chain disruptions, and inflation.

Q: Where can investors find reliable information about Apple's earnings?

A: Apple's investor relations website, financial news websites (e.g., Reuters, Bloomberg), and analyst reports.

Q: What is earnings guidance?

A: Earnings guidance is a financial forecast that the business provides to give stakeholders an idea of its expected future financial performance.

Keywords: Apple Earnings, iPhone Sales, Services Revenue, EPS, Gross Margin, Tech Stocks, Financial Report, Apple Stock, Investment Analysis, Quarterly Earnings, Apple Financials, Stock Market

Apple To Announce Q3 2025 Earnings Today Here S How To Listen In Live Slack Imgs LH6HHB 1536x768 Apple S August Advantage Can Earnings And Tariff News Supercharge The Apple Seasonal Analysis Seasonax 29 7 25 1100x620 Apple Earnings Updates Analysts Want Updates On AI Progress IPhone 688b4c44f748d8c055f69cb9 Big Tech Earnings What To Expect This Week Big Tech Earnings What To Expect This Week Handicapping Apple S Fiscal Q3 2025 Earnings Philip Elmer DeWitt Handicap Q32025 Apple Q2 2025 Earnings Preview IPhone Expectations Continue To Move Image 1705316992 Going Into Earnings Is Apple Stock A Buy A Sell Or Fairly Valued Ca129aad 9614 4bf0 993b 3df5f6bfa41e Apple Is In Need Of A Win As It Reports Earnings This Week DNyuz 6889161485e81483682edeba

Apple Earnings Under Pressure From Tariffs Slow AI Roll Out By Reuters LYNXMPEL6T0J2 L Apple S August Advantage Can Earnings And Tariff News Supercharge The Apple Inc 29 7 25 The Week Ahead Fed BoJ Rate Decisions Apple Earnings US Jobs GettyImages 2201820009 Apple S August Advantage Can Earnings And Tariff News Supercharge The Technical Analysis Apple Seasonax 29 7 25 1 Microsoft MSFT Meta META And Apple S AAPL Earnings Explained Risk And Reward Risk Of The Week 250729 Apple To Report Q3 Earnings With Focus On AI Progress Tariff Costs EyJidWNrZXQiOiJwYS1jZG4iLCJrZXkiOiJ1cGxvYWRcL05ld3NcL0ltYWdlXC8yMDI1XzA3XC8yMDI0LTA3LTI5LTE1LTA1LTI0LWE0OTY4NWNkNTc2NDg2OWQ2M2VmMDFiODIwYzY3MjBmLmpwZyIsImVkaXRzIjp7InJlc2l6ZSI6eyJ3aWR0aCI6NjExLCJoZWlnaHQiOjM1NSwiZml0IjoiY292ZXIifX19Qualcomm S Q2 2025 Earnings Beat Estimates As Company Posts Revenue Of Qualcomm 2 Tariffs And Delayed AI Strategy Weigh On Apple S Earnings Tariffs And Delayed AI Strategy Weigh On Apples Earnings 768x415

What To Look For When Apple AAPL Reports Q3 FY25 Results AlphaStreet Apple Q2 2025 Earnings Infographic Apple AAPL Is About To Report Q3 Earnings Tomorrow Here Is What To Apple Stock 750x406 Apple S 2025 Earnings Report Challenges And Opportunities Ahead News Iphone 563067.webpWhat To Expect From Apple S AAPL Q2 Earnings FinancialContent Apple Total Revenue 2025 07 30 030349 Vomb Ahead Of Earnings Apple Under Pressure From Slow To No AI Roll Out U 210513 Apple Logo DiElNq Apple Stock Rises Amid AI Hype And 490M Settlement Shadow 20250729 AAPL Analysts Bullish Ahead Of Earnings But 490M China IPhone Settlement Still Weighs Techi@2x 984x492.webpApple And Amazon Earnings In Focus Amid Market Pressures And AI CB 8ca1dimage Story Apple AAPL Stock And The AI Driven Upgrade Cycle Strategic Shifts Compress Aime Generated 1753629191825

What To Expect From Apple S AAPL Q2 Earnings FinancialContent Apple Cover Image Eeb8563872a1 2024 09 17 111539 Hybk Apple S Foldable Future Key For Stock AAPL As Earnings Expect To Show Does Apple Pay Dividends 2023 Apple Q2 2025 Earnings Preview IPhone Expectations Continue To Move Saupload 430875214 Apple Q2 2025 Earnings Preview IPhone Expectations Continue To Move Saupload 430875090 Apple Earnings Face Headwinds From Tariffs And AI Delays Options 2025 07 30T172615Z 2 LYNXMPEL6T0UD RTROPTP 4 GOOGLE DATA CENTRE INDIA Tariffs And Analysts What To Expect From Apple S Q3 2025 Earnings IOS 1dba1519c22efb6b00493ad46d02a745 Apple S Foldable Future Key For Stock AAPL As Earnings Expect To Show Apple Foldable Iphone Projections Apple Stock Should You Buy Or Sell AAPL Before Q3 Earnings Getty 1169538423 F5ecmq

Apple S Q3 2025 Earnings And AI Driven Growth A Test Of Strategic Compress Aime Generated 1753807431478 Apple Q2 2025 Earnings Preview IPhone Expectations Continue To Move Saupload 430875210 Apple Inc AAPL Earnings Preview Navigating Growth Tariffs And AI 2025 07 30 17 53 13 Window.width 1400