Last update images today Unlock Your Dream Home: The Mortgage Broker Advantage

Unlock Your Dream Home: The Mortgage Broker Advantage

Introduction: Navigating the Mortgage Maze

Buying a home is one of the biggest financial decisions most people make. The process can be overwhelming, filled with unfamiliar terms and complex choices. This is where a mortgage broker steps in, acting as your guide and advocate in the often-confusing world of home loans. This article dives deep into the world of mortgage brokers, explaining their role, benefits, and how to find the right one for your unique needs. Our target audience includes first-time homebuyers, those looking to refinance, and anyone simply wanting to understand the mortgage landscape better.

What Exactly Does a Mortgage Broker Do?

A mortgage broker is a licensed professional who acts as an intermediary between you, the borrower, and various lenders, such as banks, credit unions, and private lending institutions. Unlike a loan officer who works for a specific lender, a mortgage broker works independently and has access to a wide range of mortgage products. Their primary goal is to find the best loan terms and interest rates that align with your financial situation and home buying goals.

The Key Benefits of Using a Mortgage Broker

Working with a mortgage broker offers several advantages:

- Access to Multiple Lenders: Brokers have established relationships with numerous lenders, giving you access to a wider variety of loan options than you might find on your own. This increases your chances of securing a competitive interest rate and favorable terms.

- Time Savings: The process of researching different lenders and comparing loan products can be time-consuming. A mortgage broker handles this legwork for you, saving you valuable time and effort.

- Expert Advice: Mortgage brokers are knowledgeable about the intricacies of the mortgage market. They can provide expert advice, answer your questions, and guide you through the application process.

- Negotiation Power: Brokers often have the ability to negotiate with lenders on your behalf, potentially securing better terms than you could get on your own.

- Personalized Service: A good mortgage broker will take the time to understand your individual financial circumstances and goals. They will then tailor their recommendations to your specific needs.

Finding the Right Mortgage Broker for You

Choosing the right mortgage broker is crucial for a smooth and successful home buying experience. Here are some tips:

- Get Referrals: Ask friends, family, or real estate agents for recommendations. Personal referrals can be a valuable source of reliable brokers.

- Check Credentials and Licensing: Ensure the mortgage broker is properly licensed and has a good reputation. You can verify their credentials through your state's regulatory agency.

- Read Reviews: Online reviews can provide insights into other borrowers' experiences with the broker.

- Interview Multiple Brokers: Don't settle for the first broker you speak with. Interview several brokers to compare their services, fees, and expertise.

- Ask About Fees: Understand how the mortgage broker is compensated. They may receive a commission from the lender, charge a fee directly to you, or a combination of both.

- Evaluate Communication Style: Choose a mortgage broker who is responsive, communicative, and willing to answer all your questions clearly and patiently.

The Mortgage Application Process with a Broker

Once you've chosen a mortgage broker, they will guide you through the application process. This typically involves:

- Gathering Financial Documents: The broker will need to collect various documents, such as pay stubs, tax returns, bank statements, and credit reports.

- Completing the Application: The broker will help you complete the mortgage application, ensuring all information is accurate and complete.

- Submitting to Lenders: The broker will submit your application to multiple lenders to compare their offers.

- Reviewing Loan Options: The broker will present you with the loan options from different lenders, highlighting the key terms and interest rates.

- Choosing a Loan: You will work with the broker to choose the loan that best meets your needs.

- Closing: The broker will assist you through the closing process, ensuring all paperwork is in order and the transaction is completed smoothly.

Mortgage Broker Fees: What to Expect

Understanding mortgage broker fees is essential. Some brokers are paid solely by the lender, meaning their services are free to you. Others charge a fee, either upfront or as a percentage of the loan amount. Be sure to ask about all potential fees upfront and get them in writing. Transparency is key to a trusting relationship with your mortgage broker.

Mortgage Broker Q&A: Common Questions Answered

Q: Is using a mortgage broker more expensive?

A: Not necessarily. While some brokers charge a fee, they can often save you money by finding a lower interest rate or more favorable terms than you could find on your own.

Q: How do I know if a mortgage broker is reputable?

A: Check their licensing and credentials, read online reviews, and ask for referrals from trusted sources. Also, trust your gut feeling during the interview process.

Q: What if I have bad credit? Can a mortgage broker still help?

A: Yes, a mortgage broker may be able to help you find a lender who specializes in working with borrowers with less-than-perfect credit. They can also offer advice on how to improve your credit score.

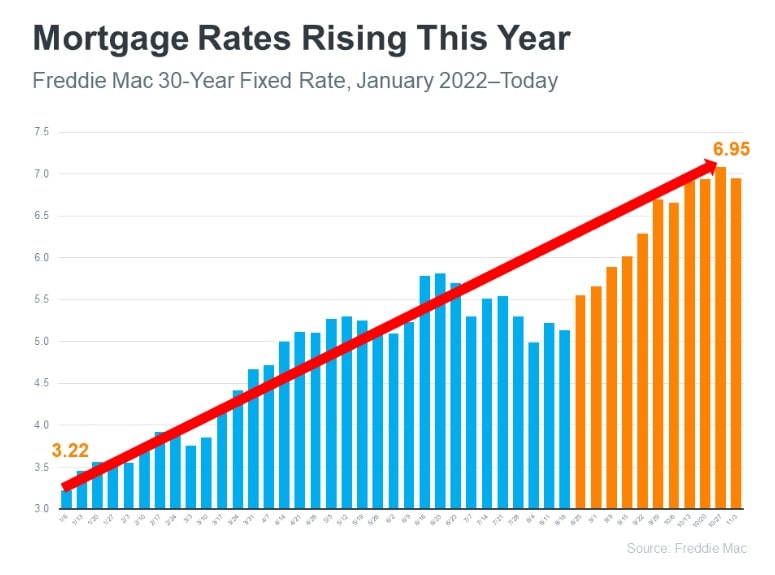

Q: Can a mortgage broker guarantee me a specific interest rate?

A: No. Interest rates fluctuate constantly based on market conditions. A mortgage broker can provide you with an estimate, but they cannot guarantee a specific rate until your loan is locked.

Conclusion: Your Partner in Homeownership

A mortgage broker can be an invaluable asset in your home buying journey. They provide expertise, save you time, and help you secure the best possible loan terms. By understanding their role and taking the time to find the right broker, you can navigate the mortgage process with confidence and achieve your dream of homeownership.

Summary Questions & Answers: What is a mortgage broker's role? They act as an intermediary between borrowers and lenders. What are the benefits of using a mortgage broker? Access to multiple lenders, time savings, and expert advice. How do I find the right mortgage broker? Get referrals, check credentials, and interview multiple brokers.

Keywords: Mortgage Broker, Home Loan, Mortgage Rates, Refinance, First Time Home Buyer, Mortgage Application, Loan Officer, Mortgage Lender, Mortgage Advice, Mortgage Fees.

Top Mortgage Employers 2025 Entries Now Open Canadian Mortgage 0321 638658023155366220 Mortgage Strategy Awards 2025 Cropped 14cd5290 Node MWLogo1 Medium Medium Mortgage Broker Business Plan Template 2025 Mortgage Broker Best Mortgage Brokers In The UK 2025 Finder UK 5f7c4903e7f25 How Mortgage Broker Tools Help Brokers Work Smarter Not Harder Predictions Blog Carousel Image 161224 1 Revenue For The Top 100 Insurance Brokers In The U S Continues To Grow Business Insurance Top 100 Insurance Brokers 2023 768x498 Mortgage Broker Meaning Advantages Disadvantages Mortgage Broker Mortgage Market Outlook For 2025 AAP Finance Brokers 2025 Market Overview

2025 Mortgage And Real Estate Predictions Where Is The Market Headed IEmergent2025mortgagevolume How To Choose A Mortgage Broker In Australia Checklist How To Choose A Mortgage Broker In Australia.webpIsraeli Mortgages The Basics And Role Of Mortgage Brokers Mortgages Property118 Mortgage Brokers Predict Just Two More Interest Rate Cuts Landbay Caution Cuts Article2 1024x819 2023 National Mortgage Brokers Day LorMet 2023 Mortgage Brokers Day Mortgage Rates Predictions For 2025 Expert Forecast Mortgage Rate Predictions 2025 Will Rates Drop Mortgage Loan Marketing Flyers Bundle Mortgage Flyers Mortgage Il Fullxfull.4832775898 Q2dt Home Mortgage Advice 1 Mortgage Broker Specialists Mortgage Broker

Best Mortgage Brokers In The UK 2025 Finder UK Mortgage Broker Fe Current Housing Interest Rates 2025 Jason H Perez 20210219 MEM 8 Trustworthy Mortgage Brokers In Singapore 2025 Keyquest Mortgage 2048x970 8 Trustworthy Mortgage Brokers In Singapore 2025 Mortgage Banner 1024x576 MBA Revises 2025 Mortgage Rate Forecast Citing Inflation Risks CRE Daily Article Images 23 1 Png.webpTop Skills Every Mortgage Broker Needs To Succeed In 2025 Mortgage Top Skills Every Mortgage Broker Needs To Succeed In 2025 2025 GOALS Ellen Frazier Mortgage Broker 2025goals 8 Trustworthy Mortgage Brokers In Singapore 2025 Mortgage Broker Feature Image 622x350

Interest Rates And The Property Market What To Expect In 2025 0446 638699724608390698 Entry Education Mortgage Broker 1200x397 How To Become A Mortgage Broker In Australia YouTube Maxresdefault Latest News Archives Proactive Finance Group Bendigo Finance Broker 2025 Mortgage Calculator Mortgage Rates By Mid 2025 Cristian Bennett Mortgage Rate Chart Southlake Flower Mound Keller Haslet Homes 2025 Mortgage Rate Forecast Experts Weigh In 2025 RATES PROJECTION CHART Horizontal How To Choose A Mortgage Broker The Essential 2024 Guide How To Choose A Mortgage Broker 1024x538 MFAA Mortgage Broker Market Share Reaches New March Quarter Record 7d3c1bdda96cd493606a7f5b432abdadd8237d7e 1200x630

Broker Market Forecast To Hit 2bn By 2025 Octane Capital Mortgage Mortgage Broker 865x460 How To Become A Mortgage Broker Step By Step Guide Mortgage Rate Predictions 2025 768x432 Top Rated Mortgage Lenders 2025 Berthe Karlie F6caa8e856e127d2ae15cccd80c5