Last update images today Loans: Unlock Your Financial Potential

Loans: Unlock Your Financial Potential

Introduction: Navigating the World of Loans

The world of loans can seem daunting, filled with confusing jargon and complex terms. Whether you're dreaming of buying your first home, starting a business, or simply consolidating debt, understanding loans is crucial for making informed financial decisions. This article will demystify the world of loans, providing you with the knowledge and tools you need to navigate it successfully. Our target audience includes young professionals, entrepreneurs, and anyone looking to improve their financial literacy.

1. Understanding the Basics of Loans

A loan is essentially an agreement where one party (the lender) provides funds to another party (the borrower) with the understanding that the money will be repaid, usually with interest, over a specific period. Loans come in many forms, each designed to serve different needs and circumstances. Before diving into specific types of loans, it's important to grasp key concepts.

- Principal: The original amount of money borrowed. Understanding loan principal is crucial.

- Interest: The cost of borrowing the money, typically expressed as an annual percentage rate (APR). Consider different loan interest rates.

- Term: The length of time you have to repay the loan. Choosing the right loan term is important.

- Collateral: An asset (like a house or car) that the lender can seize if you fail to repay the loan. Secured loans often require collateral.

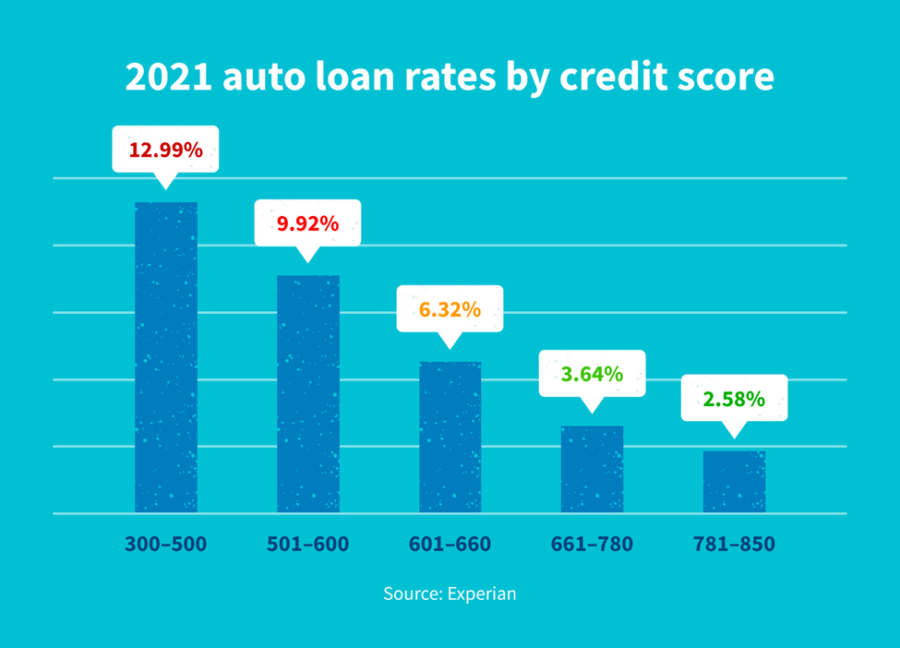

- Credit Score: A numerical representation of your creditworthiness, which significantly impacts your ability to qualify for a loan and the interest rate you receive. Improving your credit score can lead to better loan terms.

2. Types of Loans Available

The landscape of loans is diverse, offering options for virtually every financial need. Here's a breakdown of some common types:

- Personal Loans: These unsecured loans can be used for a variety of purposes, such as debt consolidation, home improvements, or unexpected expenses. Evaluate different loan options for personal use.

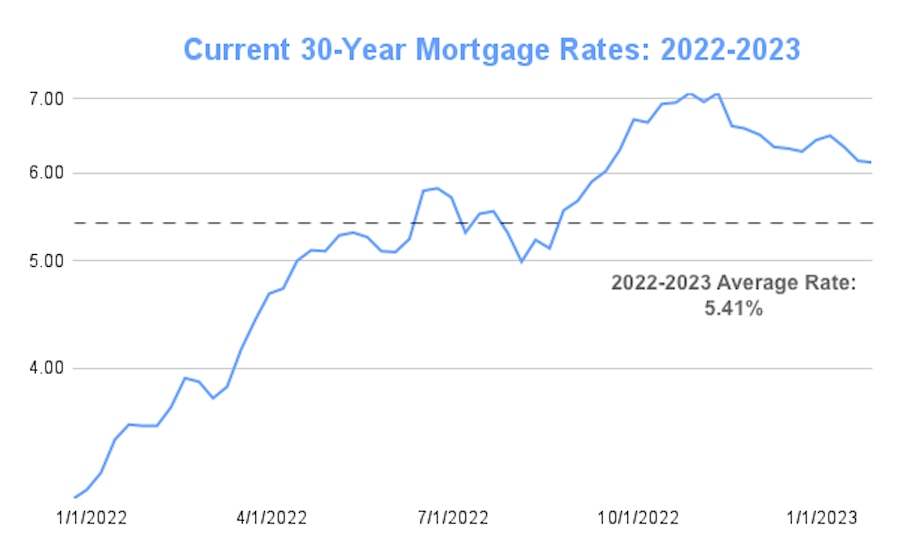

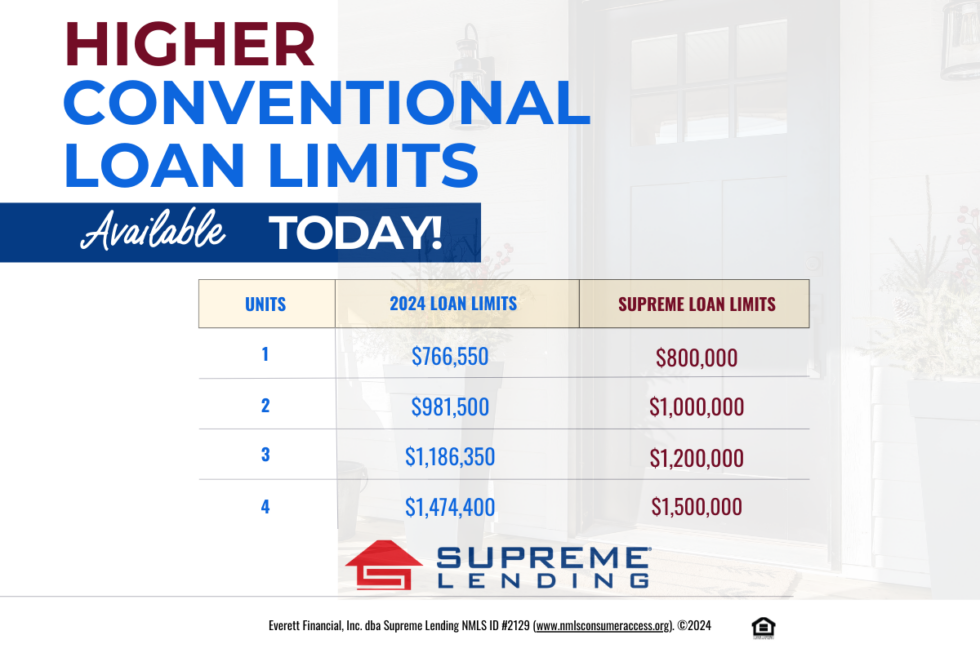

- Mortgages: Used to finance the purchase of real estate. Understanding mortgage loan options is key to homeownership.

- Auto Loans: Used to finance the purchase of a vehicle. Compare different auto loan rates before buying a car.

- Student Loans: Designed to help students pay for higher education. Managing student loan debt requires careful planning.

- Business Loans: Used to start, expand, or manage a business. Securing a small business loan can fuel growth.

- Payday Loans: Short-term, high-interest loans designed to be repaid on your next payday. Be cautious with payday loans due to their high cost.

3. The Loan Application Process

Applying for a loan can seem intimidating, but understanding the process can make it less stressful. Here's a general overview:

- Determine Your Needs: Assess how much money you need and what type of loan is best suited for your purpose. Careful planning is essential for any loan.

- Check Your Credit Score: Knowing your credit score will give you an idea of the interest rates you're likely to qualify for. Regularly monitor your credit score before applying for a loan.

- Shop Around: Compare offers from different lenders, including banks, credit unions, and online lenders. Don't settle for the first loan offer you receive.

- Gather Documentation: Lenders typically require proof of income, employment, and identity. Prepare your documents for the loan application.

- Submit Your Application: Complete the application accurately and honestly. Double-check your loan application before submitting.

- Wait for Approval: The lender will review your application and determine whether to approve your loan. Be patient during the loan approval process.

- Review the Loan Agreement: Carefully read the terms and conditions of the loan agreement before signing. Understand all the details of your loan agreement.

4. Factors Affecting Loan Approval and Interest Rates

Several factors influence whether your loan application is approved and the interest rate you receive:

- Credit Score: A higher credit score generally results in lower interest rates. Improve your credit score for better loan terms.

- Income and Employment History: Lenders want to see that you have a stable income and employment history. Demonstrate financial stability when applying for a loan.

- Debt-to-Income Ratio (DTI): This measures your monthly debt payments as a percentage of your gross monthly income. A lower DTI indicates that you're less risky to lend to. Lower your DTI for better loan approval chances.

- Collateral (if applicable): Having collateral can increase your chances of approval, especially for secured loans. Secured loans offer lower rates due to reduced risk.

- Loan Amount and Term: Larger loans and longer terms typically come with higher interest rates. Choose a loan amount and term that you can comfortably afford.

5. Tips for Managing Your Loans Responsibly

Once you've secured a loan, it's crucial to manage it responsibly:

- Make Payments on Time: Late payments can damage your credit score and result in late fees. Set reminders to avoid missing loan payments.

- Create a Budget: Track your income and expenses to ensure you can afford your loan payments. A budget helps you manage your loan repayment.

- Avoid Taking on More Debt: Resist the temptation to take on additional loans while you're already repaying one. Focus on paying off your existing loan before taking on new debt.

- Consider Refinancing: If interest rates drop, consider refinancing your loan to potentially lower your monthly payments. Refinancing can save you money on your loan.

- Communicate with Your Lender: If you're facing financial difficulties, contact your lender immediately. They may be able to offer options like forbearance or a modified repayment plan. Open communication with your lender is important when struggling with loan repayment.

6. Celebrities and Loans: A Cautionary Tale (Hypothetical)

While many celebrities manage their finances wisely, some have faced challenges with loans and debt. Let's consider a hypothetical example.

- Hypothetical Celebrity: Anya Sharma

- Who is Anya Sharma?: Anya Sharma is a fictional, rising star in the music industry. She gained rapid fame with her debut album and subsequent tours.

- Biography: Anya Sharma, age 25, burst onto the scene with her unique blend of pop and electronic music. Her debut album, "Starlight," topped the charts, leading to sold-out concerts and endorsements. Overwhelmed by her newfound wealth, Anya made several impulsive purchases, including a luxury mansion and several high-end vehicles, financing them with significant loans.

- Anya's Loan Story: Anya, eager to maintain her lavish lifestyle, took out several loans without fully understanding the long-term implications. When her second album didn't perform as well as her first, her income plummeted. Suddenly, she struggled to meet her loan payments. Her mansion was at risk of foreclosure, and her credit score took a significant hit. Anya's story highlights the importance of responsible loan management, even for those with seemingly unlimited resources. Her experience serves as a reminder that understanding and managing loans wisely is crucial for everyone, regardless of income level. Anya eventually had to sell some assets, consolidate her loans, and work with a financial advisor to get back on track.

7. Common Loan Mistakes to Avoid

- Not Shopping Around: Settling for the first loan offer without comparing others.

- Borrowing More Than You Need: Taking out a larger loan than necessary.

- Ignoring the Fine Print: Failing to read and understand the terms and conditions of the loan agreement.

- Not Budgeting for Repayments: Failing to create a budget to ensure you can afford the monthly payments.

- Using Payday Loans: Relying on short-term, high-interest loans as a regular source of funding.

- Ignoring Credit Score: Not monitoring and improving credit score before applying for a loan.

Conclusion: Empowering Your Financial Future with Loans

Navigating the world of loans doesn't have to be intimidating. By understanding the basics, exploring different types of loans, and managing your loans responsibly, you can unlock your financial potential and achieve your goals. Remember to shop around, read the fine print, and always prioritize responsible borrowing.

Keywords: Loans, personal loans, mortgage, auto loans, student loans, business loans, payday loans, credit score, interest rates, loan application, debt consolidation, refinancing, debt-to-income ratio, loan management, Anya Sharma, celebrity debt.

Summary Question and Answer:

- Q: What is a loan? A: An agreement where money is borrowed and repaid with interest.

- Q: What factors affect loan approval? A: Credit score, income, DTI, and collateral.

- Q: What's a key tip for managing loans? A: Make payments on time and create a budget.

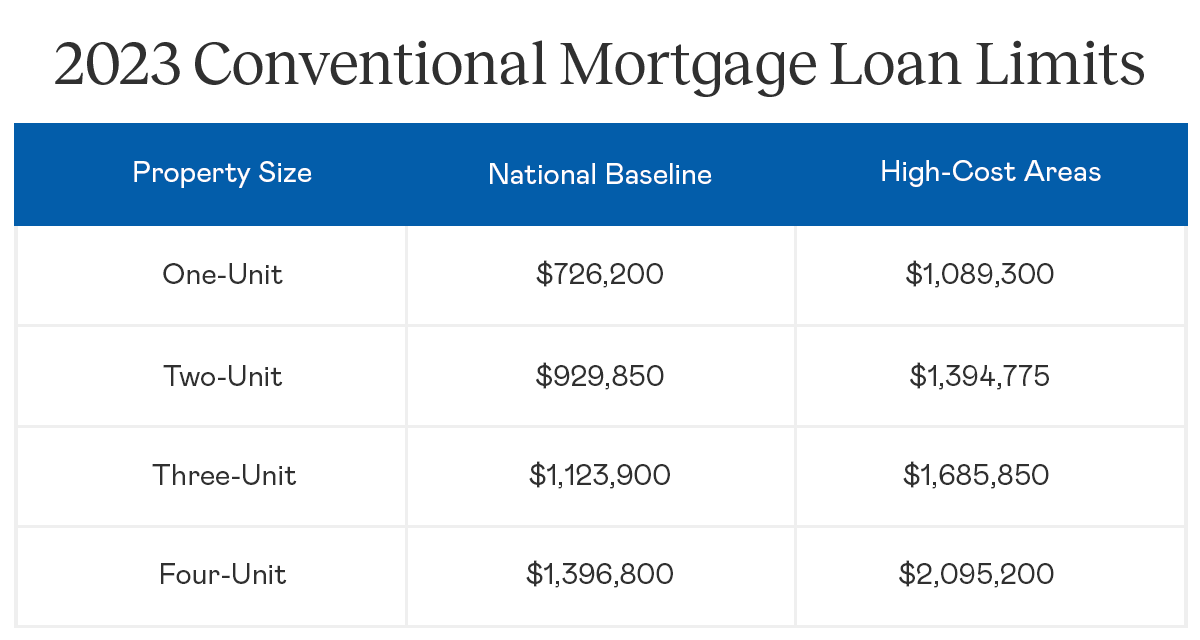

2025 S Best Debt Consolidation Loans Consolidation Credit Card Lowest Apr Personal Loans 2025 Can You Have Multiple FHA Loans 2025 Guide Multiple FHA Loans 980x653 AP Corporation Loans 2025 Complete Guide Eligibility And Application AP Corporation Laons 2025 Susbsidy And Bank Loan Details Conventional Loan Limits For 2025 REVISED Homebridge Wholesale 2025 Loan Limits Chart 300x194 Refinance Rates In 2025 Jennifer P Chew Lowest Fixed Rate Mortgage Rates Current Va Loan Rates 2025 Isaac Gray VA Home Loan Volume By State 2b66 New 2025 FHA Loans Limits Announced FHA Mortgage Source 2021 FHA Loan Limits Scaled

2025 Interest Rates By Month 2025 Doris R Perry Current 30 Year Mortgage Rates 2022 2023 AP Corporation Loans 2025 Complete Guide Eligibility And Application AP Corporation Loans 2025 Complete Guide, Eligibility, And Application Process AP Corporation Loans 2025 Complete Guide Eligibility And Application Interest Rates & Loan Amounts In AP Corporation Loans 2025 (1) How To Find The Best Student Loans And Rates In 2025 YouTube Maxresdefault Best Private Student Loans Of 2024 2025 YouTube Maxresdefault Loan Limits Archives Supreme Lending Blog 2025 Loan Limits 980x653 8 Best Banks For Small Business Loans To Consider In April 2025 Best Banks For Small Business Loans FI

Student Loan Plan 1 And 2 Threshold Increases April 2025 PAYadvice UK Image 10 Lowest Car Interest Rates 2025 Ezra Bennett Image 8 900x648 Will Car Interest Rates Go Down In 2025 Images References Jessica 2021 Auto Loan Rates Interest Rates 2025 Mortgage Zahid Skye Mortgage Rates Payments By Decade INFOGRAPHIC Fha Limits 2025 R Victor Martin Mimutual Campaign FHA Loan Limit Increase 2024 Chart 1000x445 Scaled Read The Memo Pausing Federal Grants And Loans The New York Times Output 1 Best New Car Interest Rates 2025 Hana Monroe Average Auto Loan Rates 2025 Leveraged Loan Market Survey FTI Consulting Ken Ditzel 1741274642355

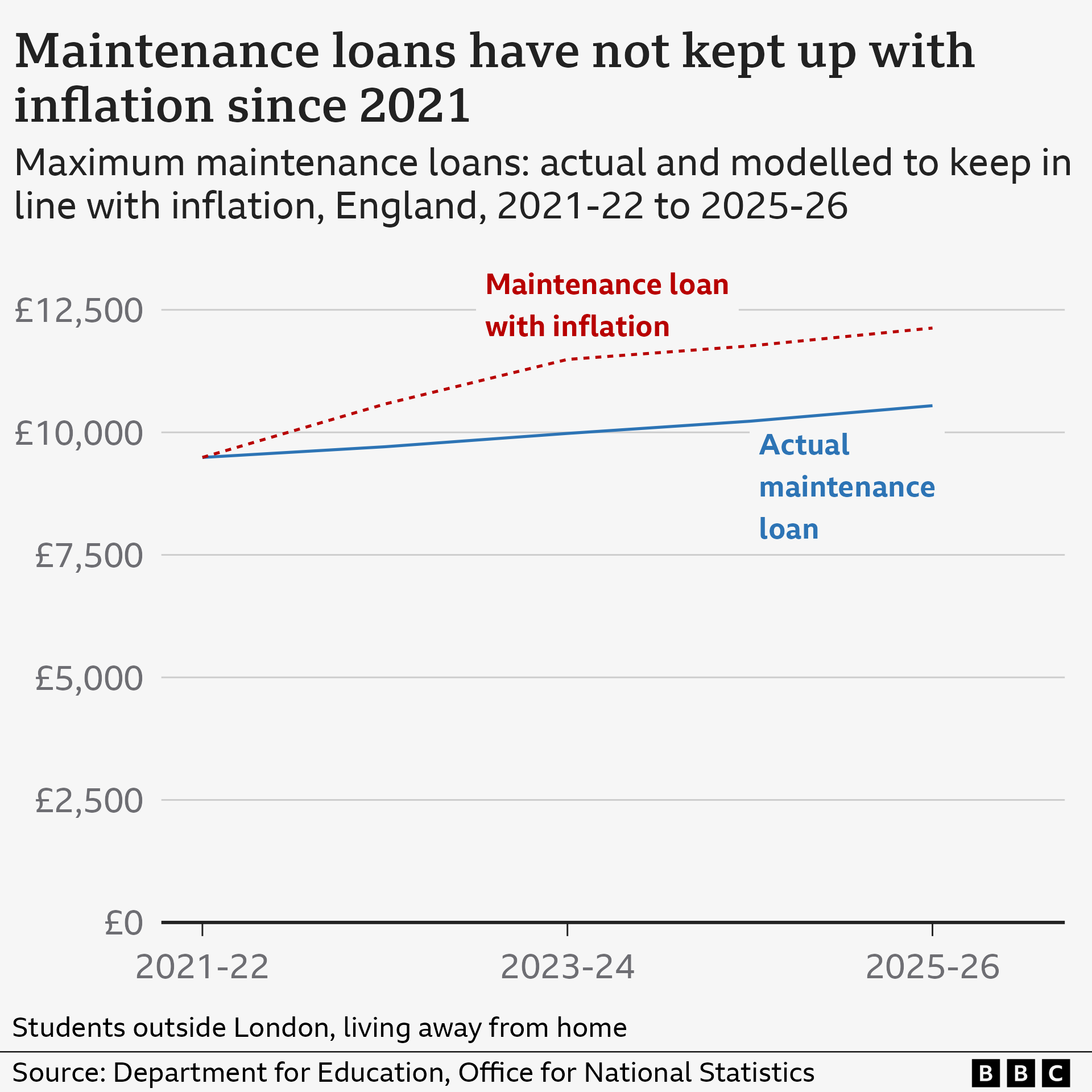

Ap Subsidy Loans 2025 5 ApSubsidyLoans2025 University Tuition Fees Rising To 9 535 In England BBC News 0a44ad10 9ad1 11ef 9260 19e6a950e830 Mortgage Tech Trends What You Should Know AD Mortgage Blog FHA Loans In 2025 800x450.webpAP Govt Subsidy Loans 2025 BC Corporation Loans APOBMMS Loans OC Maxresdefault Conventional Loan Limits 2025 Florida Online Mary Hemmings ConventionalLimits Chart 2024 2025 Federal Student Loan Interest Rate Changes Explained YouTube Maxresdefault Interest Rates 2025 Mortgage Maya Quinn Nmn071919 Rates New Conforming Limits 2025 Omar Clara 2025 FHFA Loan Limits Open Graph

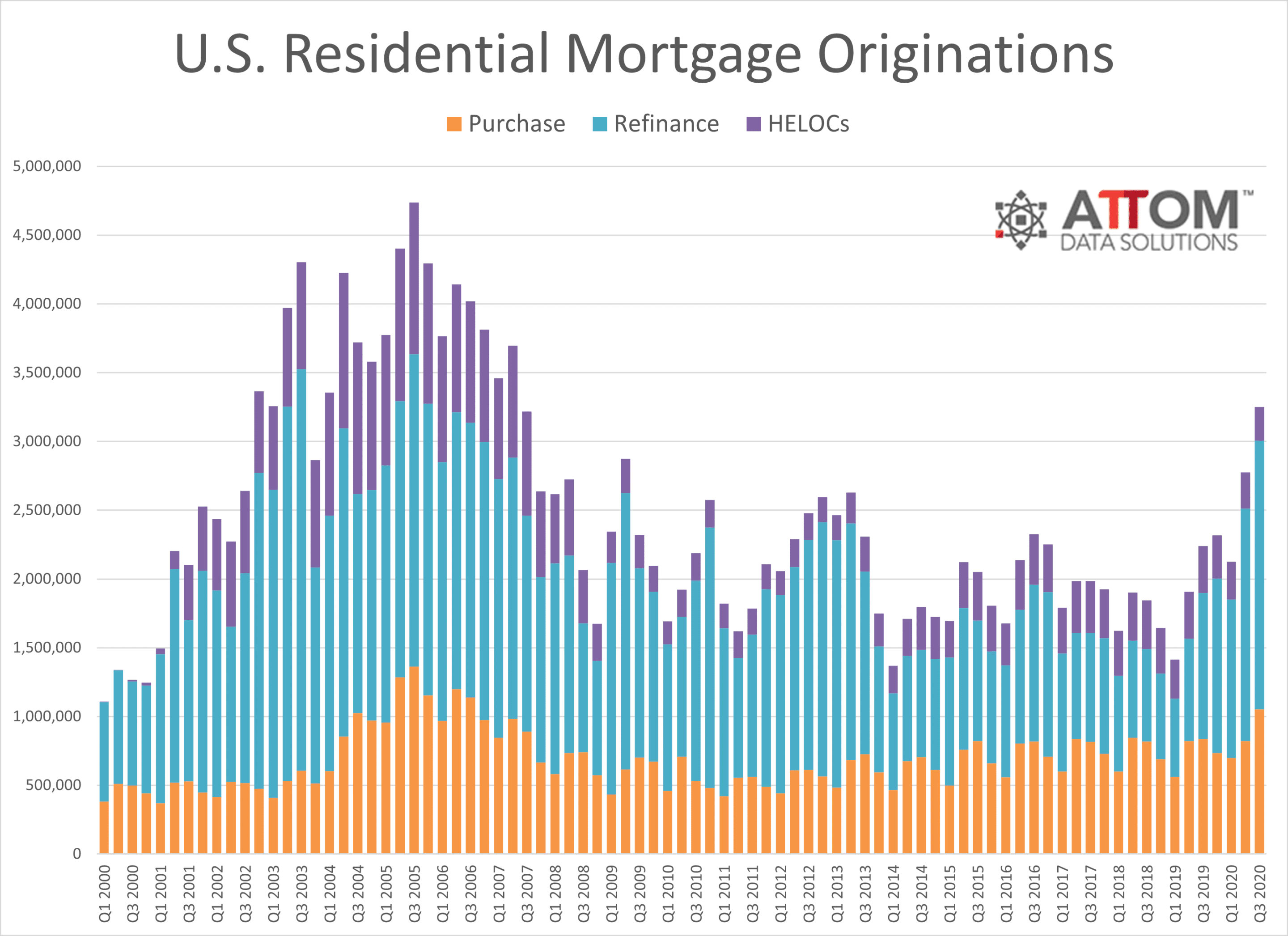

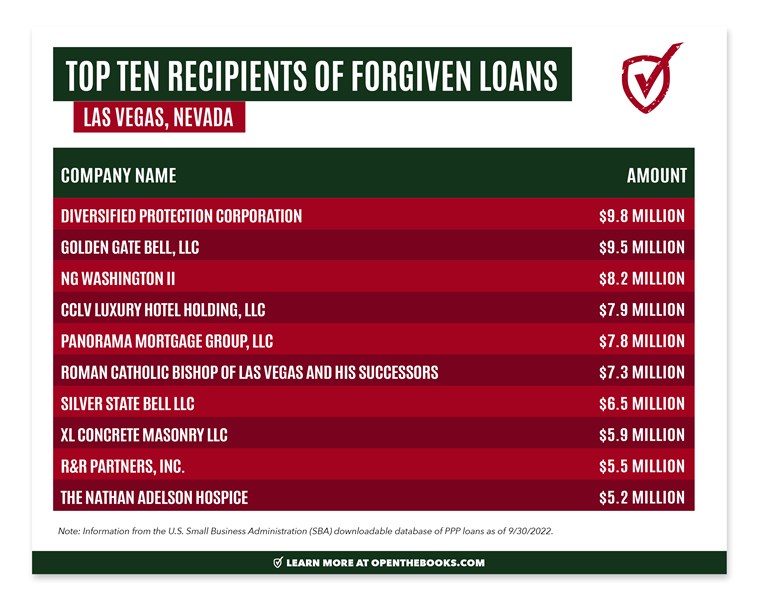

2025 Mortgage Rates By Month Wise Richard H Tate US Residential Mortgage Originations Graph Punjab Govt Loan Scheme 2025 For Business Up To 30 Million Galaxy World Punjab Govt Loan Scheme 2025 For Business Up To 30 Million Ppp Loans For 2025 Inaya Quinn Vegas PPP Loans3

.jpg)