Last update images today Axon Stock: Analyzing The Future Of Law Enforcement Tech

Axon Stock: Analyzing the Future of Law Enforcement Tech

Introduction

The world of law enforcement is rapidly evolving, and with it, the technology that supports it. Axon Enterprise (formerly TASER International) stands at the forefront of this transformation. But is Axon stock a smart investment? This article delves into the current state of Axon, its future prospects, and what investors should consider. We will explore "Axon Stock" through a comprehensive lens, providing an informational, educational, and beyond-reference perspective.

Target Audience: Investors, financial analysts, law enforcement professionals, technology enthusiasts, and anyone interested in the intersection of technology and public safety.

Axon Stock: Understanding the Company

Axon Enterprise isn't just about TASERs anymore. While the non-lethal electroshock weapon remains a core product, the company has strategically expanded into body-worn cameras, cloud-based digital evidence management systems (Evidence.com), and a suite of other software and hardware solutions for law enforcement agencies. This diversification has been crucial for "Axon Stock's" long-term growth and stability. Axon's mission is to protect life, and its products reflect that commitment.

Axon Stock: The Core Business and Beyond

The core of Axon's business revolves around equipping law enforcement with the tools they need to operate effectively and transparently.

- TASERs: Axon's TASER devices are designed to incapacitate individuals without causing serious injury, providing officers with an alternative to lethal force.

- Body-Worn Cameras (BWCs): Axon's body cameras are increasingly standard issue for law enforcement, offering a visual record of interactions between officers and the public. This is a key driver for "Axon Stock" because it creates recurring revenue streams through subscription services and data storage.

- Evidence.com: This cloud-based platform allows law enforcement agencies to securely store, manage, and share digital evidence, streamlining investigations and improving transparency. Evidence.com is a vital component of "Axon Stock's" valuation, representing a high-margin, sticky revenue source.

- Software and Services: Axon also provides a range of software solutions for records management, dispatch, and other critical law enforcement functions. This expanding portfolio helps further solidify "Axon Stock" in the market.

Axon Stock: Market Trends and Growth Drivers

Several key market trends are fueling Axon's growth:

- Increased Demand for Accountability: Growing public scrutiny of law enforcement practices has led to increased demand for body-worn cameras and other tools that promote transparency. This creates a favorable environment for "Axon Stock".

- Focus on Officer Safety: Law enforcement agencies are increasingly prioritizing officer safety, driving demand for non-lethal weapons and other protective equipment. Axon is poised to benefit, positively influencing "Axon Stock".

- Digital Transformation of Law Enforcement: Law enforcement agencies are increasingly adopting digital technologies to improve efficiency and effectiveness, creating a significant opportunity for Axon's cloud-based software and services. This digital transformation is key for understanding "Axon Stock" potential.

- International Expansion: Axon is actively expanding its presence in international markets, opening up new avenues for growth. Increased global market share could improve "Axon Stock".

Axon Stock: Financial Performance and Key Metrics

Analyzing Axon's financial performance provides valuable insights into its investment potential. Investors should pay close attention to the following metrics:

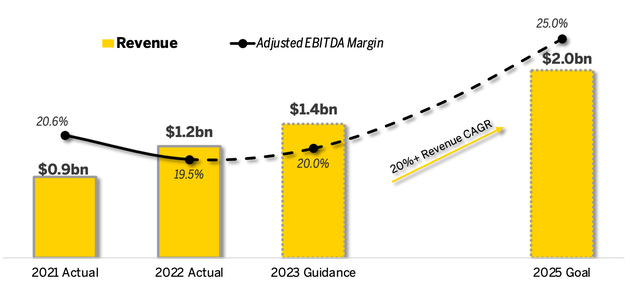

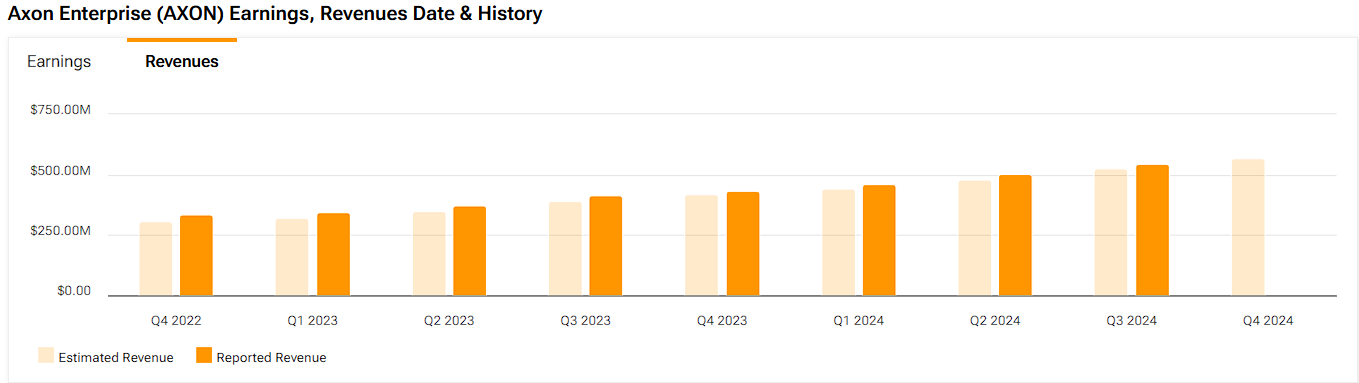

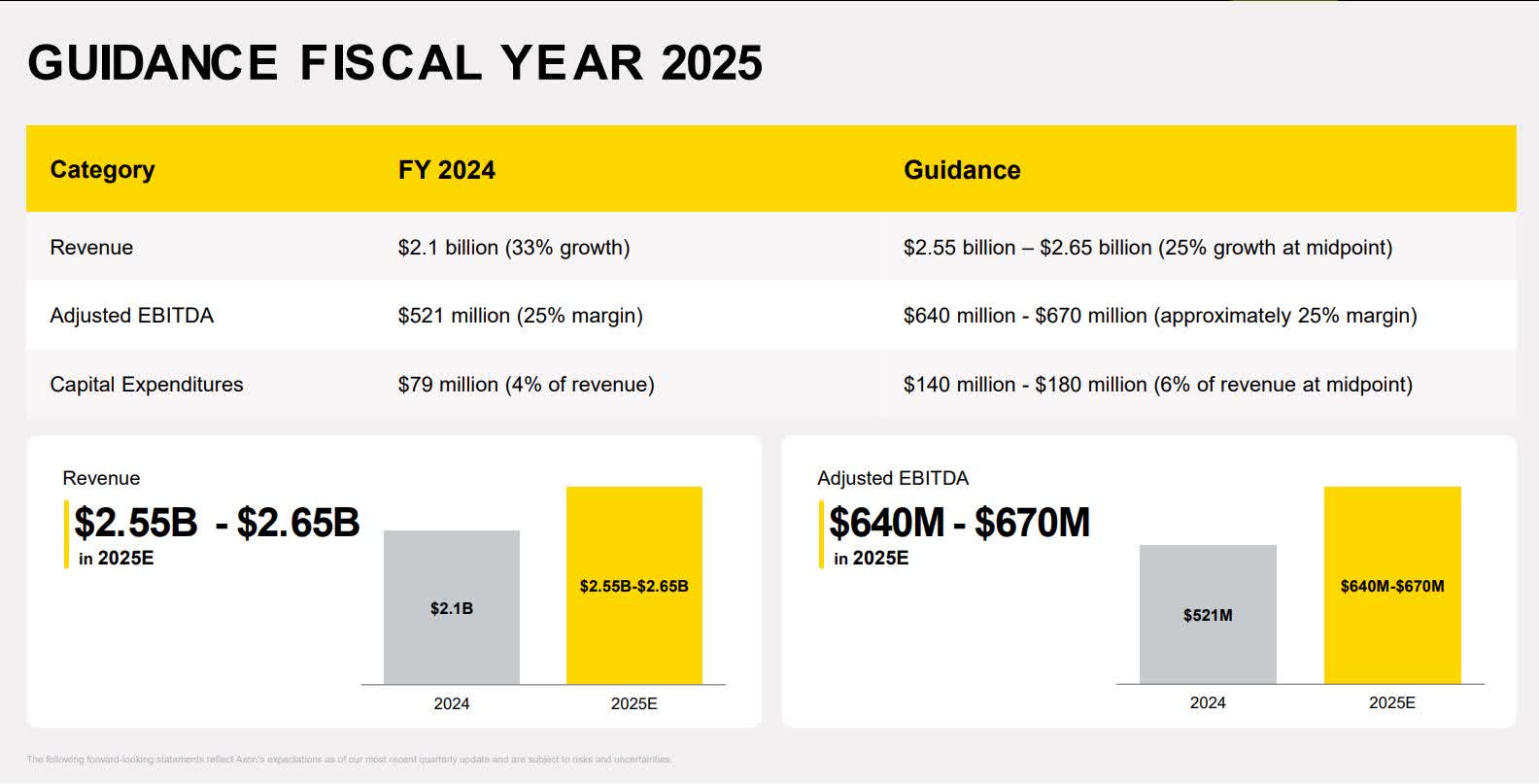

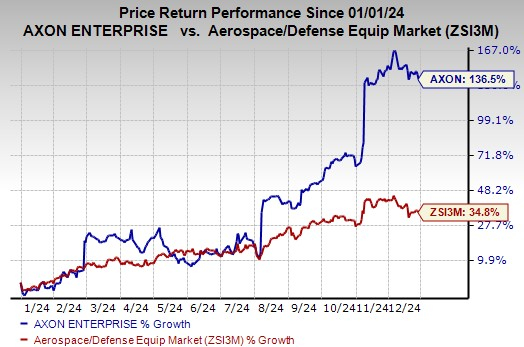

- Revenue Growth: Axon has consistently demonstrated strong revenue growth in recent years, driven by increasing demand for its products and services. This is a key indicator of the health of "Axon Stock".

- Gross Margin: Axon's gross margin is relatively high, reflecting the value of its products and services.

- Recurring Revenue: A significant portion of Axon's revenue is recurring, coming from subscriptions to its Evidence.com platform and other services. This provides a stable revenue stream and enhances the attractiveness of "Axon Stock".

- Profitability: While Axon has historically invested heavily in growth, it is becoming increasingly profitable as it scales its business. Monitoring profitability trends is crucial when evaluating "Axon Stock".

Axon Stock: Potential Risks and Challenges

Investing in Axon is not without its risks:

- Competition: The market for law enforcement technology is becoming increasingly competitive, with new players emerging and established companies expanding their offerings. Competition might put a downward pressure on "Axon Stock".

- Ethical Concerns: The use of TASERs and body-worn cameras has raised ethical concerns about privacy and potential for misuse. These concerns could affect "Axon Stock" if public perception turns negative.

- Regulatory Changes: Changes in regulations related to law enforcement technology could impact Axon's business.

- Economic Downturn: A general economic downturn could lead to reduced spending by law enforcement agencies, impacting Axon's revenue. It is important to consider how an economic downturn would impact "Axon Stock".

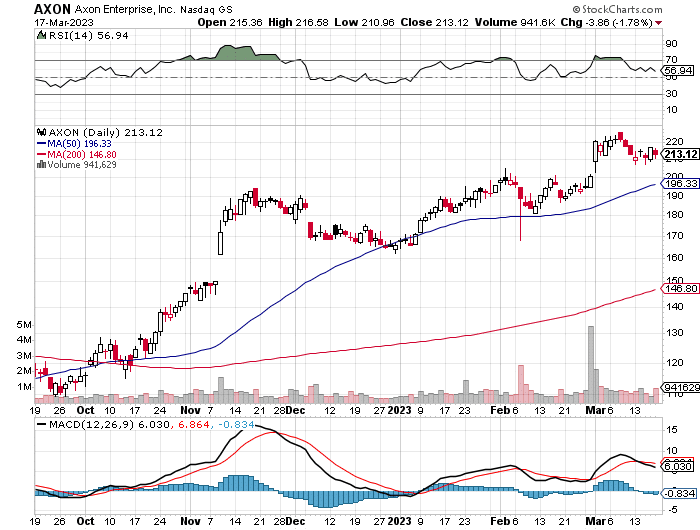

Axon Stock: Expert Opinions and Analyst Ratings

Analyst ratings on Axon stock are mixed. Some analysts are bullish on the company's long-term growth prospects, citing its strong market position and recurring revenue streams. Others are more cautious, pointing to the competitive landscape and ethical concerns. It's essential to conduct your own research and consider multiple perspectives before making an investment decision. Stay informed about "Axon Stock" by following expert analyses.

Axon Stock: Future Outlook

The future outlook for Axon remains positive, driven by the ongoing trends toward increased accountability, officer safety, and digital transformation in law enforcement. While risks remain, Axon's strong market position, recurring revenue streams, and commitment to innovation position it well for continued growth. Long-term prospects for "Axon Stock" depend on successful innovation and market adaptation.

Axon Stock: Investor Considerations

Before investing in Axon stock, consider the following:

- Your Investment Goals: Are you looking for long-term growth or short-term gains?

- Your Risk Tolerance: Are you comfortable with the risks associated with investing in a technology company?

- Your Due Diligence: Have you thoroughly researched Axon and its competitors?

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio to mitigate risk. Understanding these concepts helps investors evaluate "Axon Stock" within the broader market context.

Axon Stock: Question and Answer

Q: Is Axon stock a good long-term investment?

A: Axon has strong growth potential due to increasing demand for law enforcement technology. However, competition and ethical concerns are risks to consider.

Q: What are Axon's main revenue streams?

A: TASER sales, body-worn camera subscriptions, and Evidence.com cloud services.

Q: What are the biggest risks associated with investing in Axon?

A: Competition, ethical concerns about its products, regulatory changes, and economic downturn.

Q: Where can I find more information about Axon's financials?

A: Axon's investor relations website, financial news websites, and analyst reports.

Q: How does Axon contribute to the community?

A: Axon's products are designed to improve officer safety and transparency in law enforcement, as well as its commitment to social responsibility.

Summary: Axon Enterprise is a leading provider of technology solutions for law enforcement, with strong growth potential driven by increasing demand for accountability, officer safety, and digital transformation. While risks exist, Axon's strong market position and recurring revenue streams make it an interesting investment opportunity. Is Axon stock a good long-term investment? What are Axon's main revenue streams? What are the biggest risks? Where can I find more information? How does Axon contribute to the community? Keywords: Axon Stock, TASER, Body-Worn Cameras, Evidence.com, Law Enforcement Technology, Investment Analysis, Stock Market, Public Safety, Digital Evidence Management, Law Enforcement.

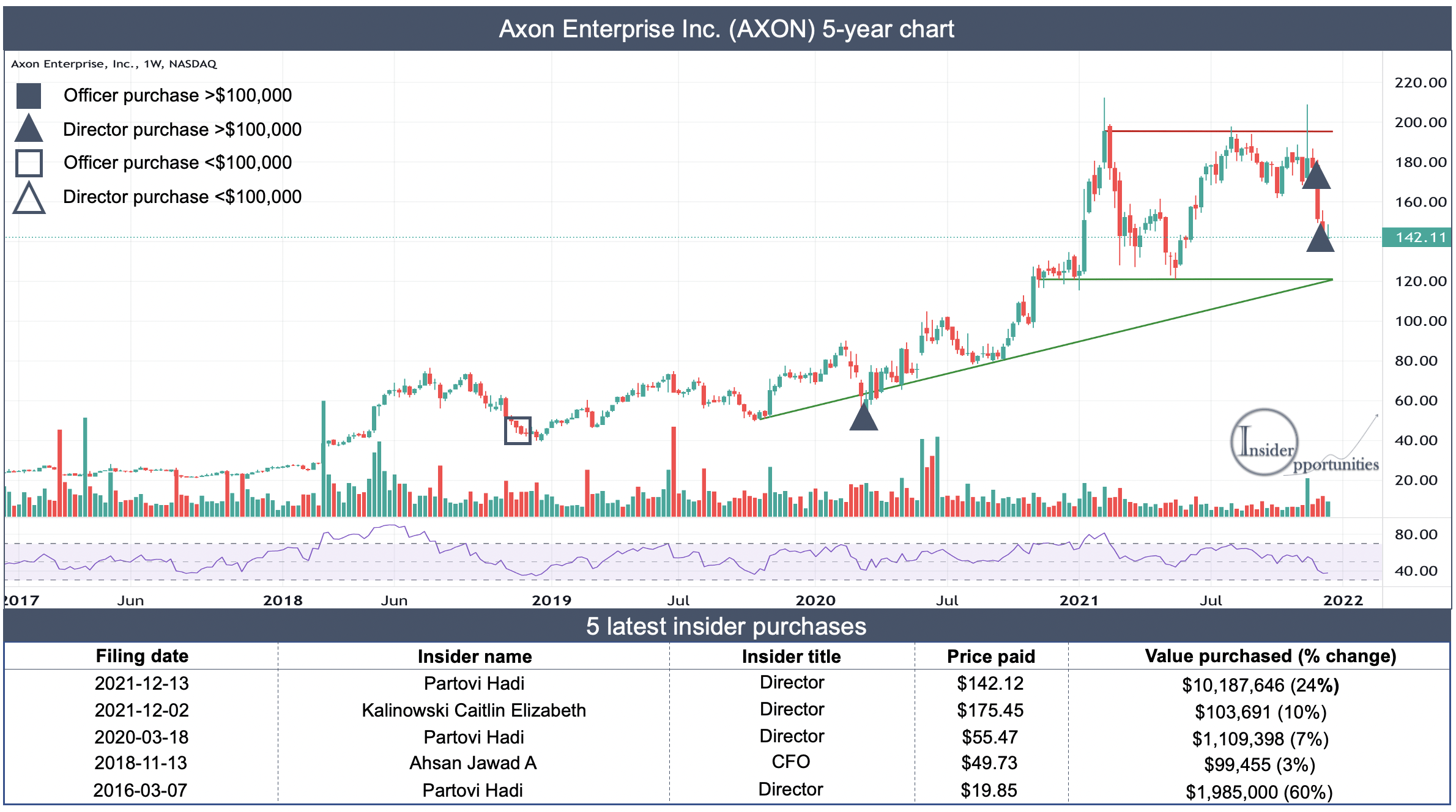

Axon Stock Forecast InsiderSentiment Com 8PoBKrphbrwe95Cq XcwcrxRYW0AkNzwGoUqcvwylH4RY XH5Ua8zxwnulzwwuju62G BqHLzun VPDfmsKljF5mpxNFyCxVH4dn1WEURdK0IaxkcD2DtUtkLfr0GBo P1Ni0Ow8wddRSA GwNOORQ3 Oversold High Growth Stocks Insiders Are Buying Heavily On This Drop 48562496 16397337522975323 Origin Here S Why You Should Consider Buying Axon AAXN Stock Now 395fd6a39e7ce3556b98e38d63968b40Axon Stock Near Buy Point As Cup Almost Runneth Over With AI Drone AXON 1 Axon Enterprise Inc Stock Price Today AXON Stock Price Chart CoinCodex AXONAerospace And Defense Stocks Q4 In Review Axon NASDAQ AXON Vs Peers Axon Cover Image F068626f3e49 2024 06 06 125550 Ofdd Axon Stock Exhibits Strong Prospects Despite Persisting Headwinds AA1wHZbU.imgAXON Stock Price Today Plus 7 Insightful Charts Dogs Of The Dow Axon Stock Price 1yr

How Is Axon S Stock Performance Compared To Other Aerospace And Defense Barchart 1a26adfc4094b B13c222f41e1d9e227b8d6517a68fede Resized AXON Stock Price And Chart NASDAQ AXON TradingView Oyg0DDd9 Mid Top 3 Prison Stocks To Buy For 2025 Trump Presidency AXON Stock Price YTD Chart Aerospace And Defense Stocks Q4 In Review Axon NASDAQ AXON Vs Peers Axon Total Revenue 2025 03 13 090804 Yvrd 3 Reasons To Buy Axon Stock Like There S No Tomorrow 5c8706d8870ac1e212dced0f2188126dAxon Enterprise Inc AXON Stock Price News Quote History Yahoo 4be26a978a61692568e28454f8b68e07.cf AXON Stock Price And Chart NASDAQ AXON TradingView X7XWnvhC Mid AXON Stock How Axon Enterprise S Market Leadership Appeals To 47657052 1741639596790937 Origin

Axon Enterprise Stock Drop Shorts Short Stock Stocks Stockstowatch Maxres2 Optivise Advisory Services LLC Buys Shares Of 399 Axon Enterprise Inc Axon Enterprise Inc Logo 1200x675 How Is Axon S Stock Performance Compared To Other Axon Enterprise Inc Logo And Site By T Schneider Via Shutterstock Axon Stock Rises On Big Money Demand And Strong Fundamentals B1b1df30afaa89913a7a186a7c140af3Axon Stock Nears Buy Point Amid FTC Antitrust Fight Sotd For 01 21 2020 Desktop 1 Axon S Stock Decline Impact Of Flock Safety Rivalry And Analyst Axon.webpIs Axon Enterprise An Electrifying Crisis Investment Financial Image 27 1 AXON Stock Price Today Plus 7 Insightful Charts Dogs Of The Dow Axon Average Year

AXON Stock Earnings Axon Enterprise Beats EPS Beats Revenue For Q3 Axon1600 AXON Axon Enterprise Inc Stock Price Forecast 2025 2026 2030 To AXON Axon Stock At A Crossroads After Motorola S 4 4B Acquisition Small 20250627102931 Reportpreviewtop 10 Best Stocks Summer 2025 Co AXON Stock Price Today Plus 7 Insightful Charts Dogs Of The Dow Axon Volatility Axon Stock Surges On Q1 Beat But Is It Priced For Perfection Med 20250514161403 Is Axon Stock Too Expensiveor Just Getting Started Axon Enterprise Inc NASDAQ AXON Keep Surging And Here S Why Image Up 134 In 2024 Is Axon Stock Overvalued The Globe And Mail Qplbn0s9y4sflxze Why Buying The AXON Pre Earnings Stock Dip Might Be A Good Idea Image 919

Axon Enterprise Fantastic Business But Valuation Presents Downside 49966653 1678666696455365 Axon Enterprise Stock Skyrocketed In 2024 And Left The S P 500 In The ImageAxon Stock Should You Buy It Just Start Investing JSI FEATURED IMAGE 43

/Axon Enterprise Inc logo and site-by T_Schneider via Shutterstock.jpg)