Last update images today Supercharge Your Savings This Season

Introduction: Unlock Your Financial Potential Through Savings

Are you ready to take control of your finances and achieve your dreams? This season, let's focus on supercharging your savings. Whether you're saving for a down payment on a house, a dream vacation, or simply building a financial safety net, this comprehensive guide will provide you with the tools and strategies you need to succeed. Many people struggle to save effectively, often feeling overwhelmed by expenses and unsure where to start. This article will break down the process into manageable steps and provide actionable advice to help you maximize your savings.

Target Audience: This article is tailored for young adults, millennials, Gen Z, young professionals, and anyone looking to improve their financial literacy and build better saving habits.

Understanding the Importance of Savings

The Power of Savings: Building a Secure Future

Savings are not just about accumulating money; they're about building a secure future and achieving financial freedom. Having a solid savings cushion provides a sense of security, allowing you to weather unexpected expenses, pursue your passions, and retire comfortably. Think of savings as an investment in your future self.

Savings: More Than Just Money in the Bank

Effective savings go beyond simply stashing money in a bank account. It's about creating a strategic plan that aligns with your financial goals and risk tolerance. This includes understanding different types of savings accounts, investment options, and tax-advantaged savings vehicles.

Strategies to Boost Your Savings This Season

Track Your Spending Habits and Find Savings Opportunities

The first step to boosting your savings is understanding where your money is going. Track your expenses for a month using a budgeting app, spreadsheet, or notebook. Identify areas where you can cut back. Small changes, like brewing your own coffee or packing lunch, can add up to significant savings over time.

Create a Realistic Budget and Stick To It

A budget is your roadmap to financial success. Create a budget that allocates your income to essential expenses, debt repayment, and savings. Prioritize savings by treating it as a non-negotiable expense. Automate your savings by setting up automatic transfers from your checking account to your savings account each month.

Automate Your Savings: The Secret to Consistent Growth

One of the most effective ways to increase your savings is to automate the process. Set up automatic transfers from your checking account to your savings account each month. This ensures that you consistently save without having to think about it. Even small, regular transfers can make a big difference over time. You can adjust the amount you save as your income increases or your expenses decrease.

Optimize Your Savings: Embrace the Power of Compound Interest

Consider opening a high-yield savings account to maximize your savings. These accounts offer higher interest rates than traditional savings accounts, allowing your money to grow faster. Explore other investment options, such as certificates of deposit (CDs) or money market accounts, to potentially earn even higher returns. Understand the power of compound interest, where you earn interest not only on your initial investment but also on the accumulated interest.

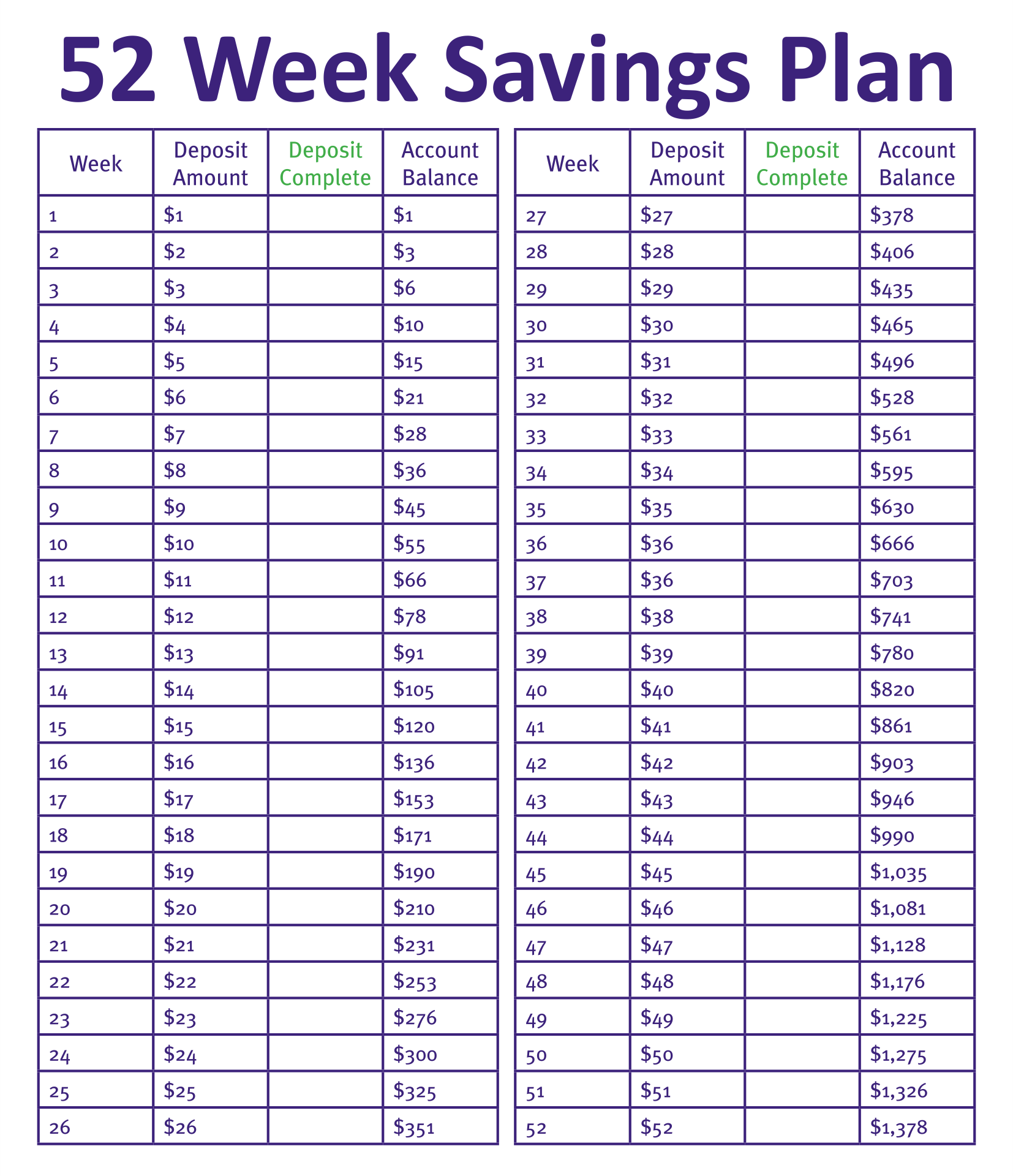

Savings Challenges: Fun Ways to Reach Your Goals

Make savings fun by participating in a savings challenge. Try the 52-week savings challenge, where you save a small amount each week, gradually increasing the amount over the year. Or create your own personalized savings challenge based on your specific goals.

Reduce Debt: Free Up Money for Savings

High-interest debt can eat away at your savings. Prioritize paying down high-interest debt, such as credit card debt, to free up more money for savings. Consider consolidating your debt or negotiating lower interest rates. The less you pay in interest, the more you can save.

Side Hustles: Supplement Your Income and Boost Savings

Consider starting a side hustle to supplement your income and accelerate your savings. There are many opportunities to earn extra money, such as freelancing, driving for a ride-sharing service, or selling products online. Dedicate the extra income you earn from your side hustle entirely to savings.

Cut Unnecessary Expenses: Identify Areas for Savings

Take a hard look at your spending habits and identify unnecessary expenses. Cancel subscriptions you don't use, cut back on dining out, and find cheaper alternatives for products and services you regularly purchase. Small changes can add up to significant savings over time.

Set Financial Goals and Visualize Your Success

Clearly define your financial goals and visualize your success. Having a clear understanding of what you're saving for can help you stay motivated and focused. Whether it's a down payment on a house, a dream vacation, or early retirement, write down your goals and track your progress.

Negotiate Bills: Reduce Recurring Expenses and Increase Savings

Don't be afraid to negotiate your bills, such as your cable, internet, and insurance rates. Contact your service providers and ask if they can offer you a better deal. You might be surprised at how much you can save by simply asking.

Common Savings Mistakes and How to Avoid Them

Lack of a Budget: The Foundation of Effective Savings

Failing to create a budget is a common savings mistake. Without a budget, it's difficult to track your spending and identify areas where you can cut back. Take the time to create a budget that aligns with your financial goals.

Not Paying Yourself First: Prioritizing Savings

Many people make the mistake of spending first and saving what's left over. Instead, prioritize savings by paying yourself first. Set aside a portion of your income for savings before you pay your bills or make discretionary purchases.

Ignoring High-Interest Debt: Hampering Savings Potential

Ignoring high-interest debt can significantly hamper your savings potential. The interest charges can eat away at your income and make it difficult to save. Prioritize paying down high-interest debt as quickly as possible.

Dipping Into Savings: Undermining Progress

Avoid dipping into your savings unless it's for a true emergency. Regularly withdrawing from your savings can undermine your progress and make it difficult to reach your financial goals. If you find yourself frequently dipping into your savings, re-evaluate your budget and spending habits.

Not Taking Advantage of Employer Matching: Missing Out on Free Money

If your employer offers a retirement savings plan with matching contributions, take advantage of it. This is essentially free money that can significantly boost your savings. Contribute enough to your retirement account to receive the full employer match.

Celebrating Savings Successes: Stay Motivated on Your Journey

Acknowledge Milestones: Keeping the Momentum Going

Celebrate your savings successes, no matter how small. Acknowledge your milestones and reward yourself (within reason) for reaching your goals. This can help you stay motivated on your savings journey.

Review and Adjust: Adapting to Changing Circumstances

Regularly review and adjust your savings plan as needed. Your financial situation may change over time, so it's important to adapt your plan accordingly. Re-evaluate your goals, track your progress, and make adjustments as necessary.

Stay Informed: Continuously Learn About Savings Strategies

Continuously learn about savings strategies and investment options. Read books, articles, and blogs on personal finance. Attend seminars and workshops to improve your financial literacy. The more you know, the better equipped you'll be to make informed decisions about your savings.

Conclusion: Embrace the Power of Savings This Season

This season, commit to supercharging your savings and achieving your financial goals. By implementing the strategies outlined in this guide, you can take control of your finances, build a secure future, and achieve financial freedom. Remember that saving is a journey, not a destination. Stay consistent, stay motivated, and celebrate your successes along the way.

Summary Question and Answer:

- Q: How can I start saving more effectively this season?

- A: Track your spending, create a budget, automate savings, reduce debt, and explore side hustles.

- Q: What are some common savings mistakes to avoid?

- A: Lack of a budget, not paying yourself first, ignoring high-interest debt, and dipping into savings.

- Q: How can I stay motivated on my savings journey?

- A: Set financial goals, celebrate successes, and stay informed about savings strategies.

Keywords: Savings, budget, finance, money, debt, investments, financial freedom, financial goals, savings account, high-yield savings, compound interest, budgeting, savings challenges, side hustle, financial planning, financial literacy, automate savings.

How To Save Money In 2025 50 Tips To Grow Your Wealth Aa175970 2ce3 11ef B7ee 91d3c92b1f412025 Daylight Savings Dates In Liv Marthe Daydaylight Saving Time March 12 2023 Concept Clock Set To An Hour Ahead Spring Forward Summer Time Web Banner With Call To Switch To Dst Vector Printable Savings Tracker Save 2025 In 2025 Financial Goals Templat Il Fullxfull.6175584409 S7zp 2025 Daylight Savings Beginsel Mark J Morrissey Daylight Saving Time 2025 2025 Savings Challenge Save 2025 In 2025 Printable Budget Tracker Il 1080xN.6482179454 Rylz Daylight Savings Ends 2025 Date Australia 2025 Oliver Mustafa FsmkPGWaYAIAP9C 15 Savings Tracker Printables To Visualize Your Progress Artofit B1e6f7cd54bd7ca76c4de85da0d635b2

Savings From 2022 To 2025 Stock Photo Download Image Now 2022 2023 Savings From 2022 To 2025 52 Week Money Challenge Saving Plan Free Printable 52 Week Saving 2e4946592b0b98e24cb759dbe9eaf53e 2025 Savings Challenge Etsy Il Fullxfull.6063109612 1eqx Save 2025 In 2025 AND Save 225 In 2025 Savings Challenges Two Printable Iap 400x400.6019284884 Igy7y46k 7 Best Savings Plan For 2025 Secure Your Future Today 9 2 1024x1024 7 Saving And Retirement Rule Changes For 2025 Quick And Dirty Tips MG Saving Retirement 2025 300x187 Daylight Saving Time 2025 Dates Significance And Benefits Daylight Savings 2025.webpSpring Forward Expert Tips Tricks For Surviving 2025 S Time Change What Is Daylight Savings 2025 Timing

52 Week Savings Challenge Printable Pdf Free Printable 52 Week Savings Plan 359079 Best Savings Accounts March 2025 Cecil M Carlson F6cd9970 D9d0 4840 8721 7398d41ca238 2025 Savings Challenge Low Income Etsy Canada In 2024 Saving Money A907e407f33886f2ec4a791c7b47a314 Premium Photo A Transparent Jar Marked Savings 2025 Brimming With Transparent Jar Marked Savings 2025 Brimming With Coins Notes Representing Financial Resolution Better Savings Money Management 2025 2025 New Year Resolutions 1069077 6740 Spring Forward The 2025 Clock Change You Won T Want To Forget 190304 D YE683 001.JPGWhen Is Daylight Savings 2025 Usa 2025 Khadija Skye INFOGRAPHIC Daylight Saving Time By The Numbers Save 2025 In 2025 AND Save 225 In 2025 Savings Low Income Savings Il 1080xN.6260975642 Emlu Savings From 2022 To 2025 Stock Photo Download Image Now 2025 Savings From 2022 To 2025

Printable Savings Challenge 2025 Etsy Il 600x600.6057375079 4waz Daylight Savings Time 2025 Australia 2025 Images References Nour Noor Daylight Saving Time Conversion Chart Mkcky 2025 Savings Challenge Printable Save 2025 In 2025 2025 Saving Il 1080xN.6372051682 Fa3f Save 2025 In Year 2025 Saving Challenge Cash Envelope Printable Saving Il Fullxfull.6005290838 Pasj Daylight Savings Time 2025 Spring Ava Sashenka Daylight Saving Time March 12 2023 Concept Clock Set To An Hour Ahead Spring Forward Summer Time Web Banner With Call To Switch To Dst Vector Daylight Savings 2025 Australia Time June J Duncan Daylight 28 Feb 20 2025 Savings Challenge Save 2025 In 2025 Savings Challenge Printable Il 1140xN.6173490477 K9qb 2025 Savings Challenge Save 2025 In 2025 Savings Challenge Bundle 2k Il 300x300.6165535455 Et32

Savings Challenge 2025 Marius F Rasmussen Biweekly Money Saving Challenge 13 Printable 2025 Savings Challenge Ease Into 2025 A Seasonal Digital Il 1080xN.5920462012 Ddlw Money Saving Challenge Save 2025 In 2025 Grafica Di Customizables Money Saving Challenge Save 2025 In 2025 Graphics 109028214 1 580x387