Last update images today Duolingo Stock: Is Now The Time To Invest

Duolingo Stock: Is Now the Time to Invest?

Duolingo Stock: Introduction - Beyond the Owl, What's the Investment?

Duolingo (DUOL) has become synonymous with language learning, its quirky green owl a familiar face to millions. But beyond its popular app, Duolingo is a publicly traded company, and its stock performance is a topic of increasing interest for investors. This article delves into the world of Duolingo stock, analyzing its current performance, future potential, and key factors that investors should consider. We'll explore whether the company's growth trajectory justifies its current valuation and address common questions potential investors have. This guide is for anyone considering adding DUOL to their portfolio, from beginner investors to seasoned market watchers.

Duolingo Stock: Current Performance and Market Analysis

Analyzing Duolingo stock requires understanding the broader market context. The stock market in general has been volatile recently due to factors like inflation, interest rate hikes, and geopolitical uncertainty. This volatility can impact growth stocks like Duolingo, which are often more sensitive to macroeconomic conditions.

Specifically, Duolingo stock has experienced its own ups and downs. Examining its recent trading history reveals fluctuations influenced by quarterly earnings reports, user growth announcements, and broader market trends. Key metrics to consider include:

- Stock Price Trend: Is it trending upwards, downwards, or sideways?

- Trading Volume: Is there high or low trading activity?

- Market Capitalization: What's the overall value of the company?

- Price-to-Earnings (P/E) Ratio: How does its valuation compare to its earnings?

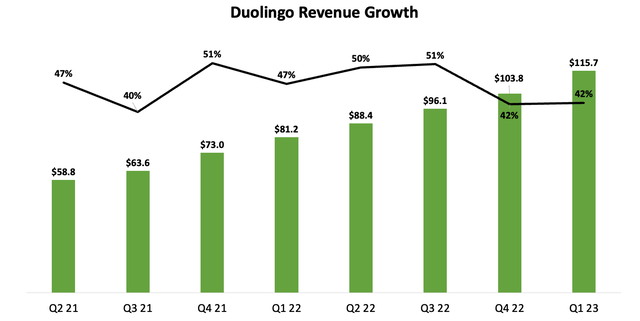

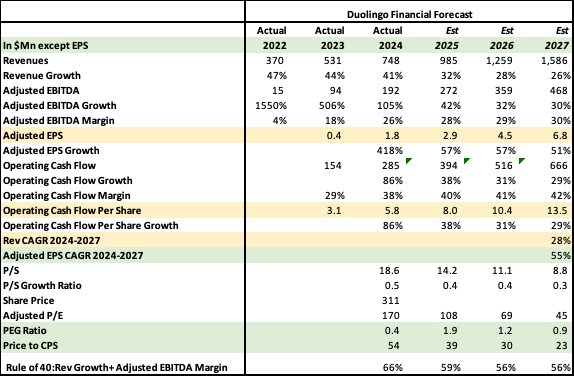

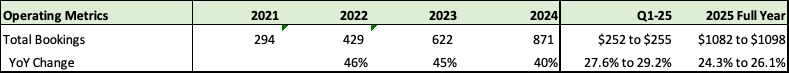

- Revenue Growth: Is the company consistently growing its revenue?

These metrics provide a snapshot of the company's current financial health and market perception. Keep in mind that past performance is not necessarily indicative of future results.

Duolingo Stock: Key Growth Drivers and Future Potential

Several factors contribute to Duolingo's growth potential.

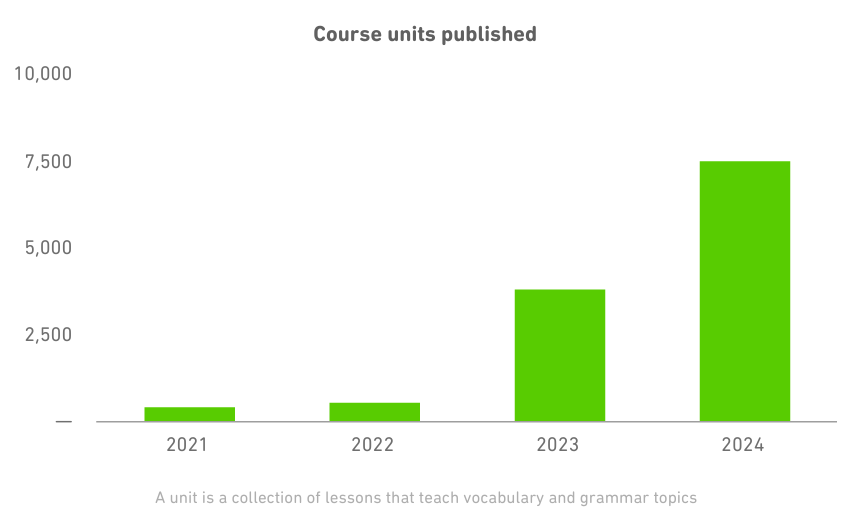

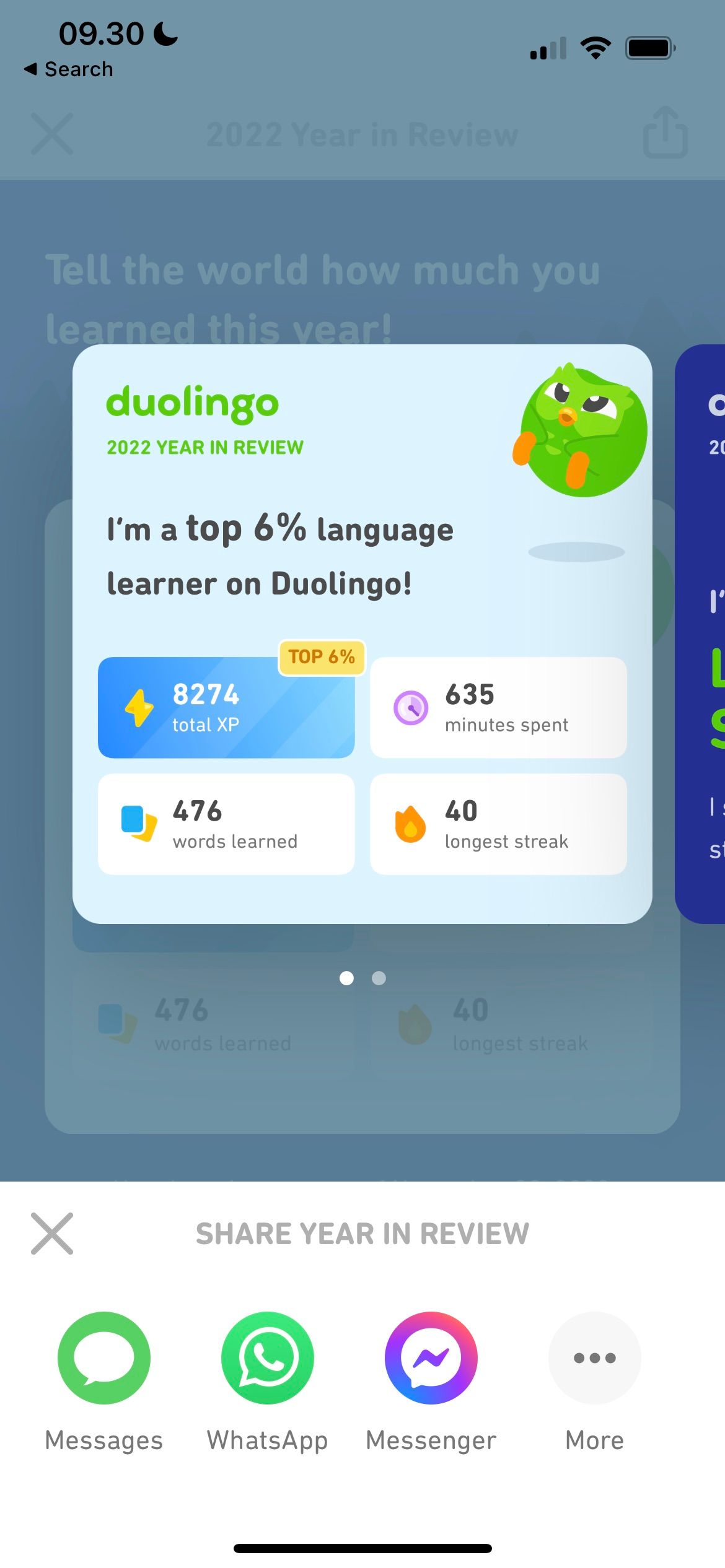

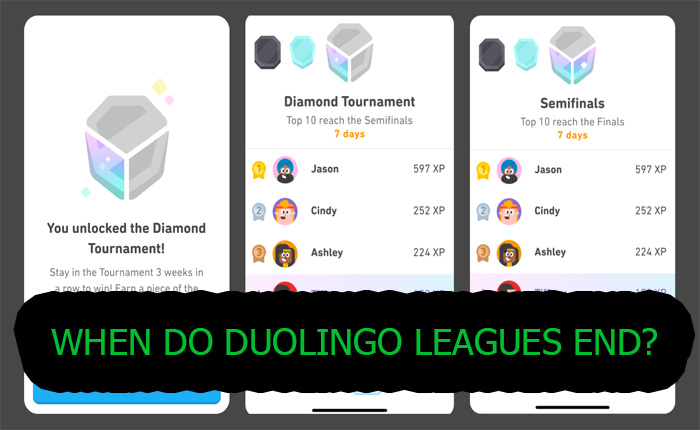

- User Growth: Duolingo boasts a massive user base, but continued growth depends on attracting new users and retaining existing ones. The company's gamified learning approach, personalized content, and social features contribute to user engagement.

- Monetization Strategy: Duolingo primarily generates revenue through subscriptions (Duolingo Plus) and advertising. Expanding its monetization strategy, such as introducing new premium features or exploring partnerships, could boost revenue.

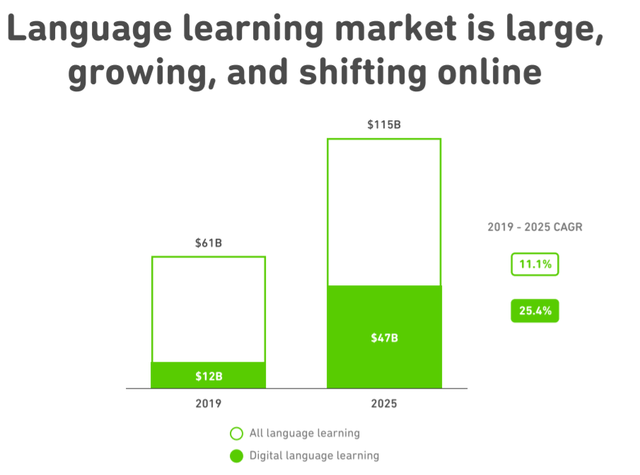

- Expansion into New Markets: Duolingo is available worldwide, but significant growth opportunities exist in emerging markets with increasing internet access and a desire for language learning.

- New Product Development: Beyond language learning, Duolingo has expanded into other areas, like math and music. Successfully launching and scaling new products could diversify revenue streams and attract new users.

Analysts' projections for Duolingo's future growth vary. Some predict continued strong user growth and revenue increases, while others express caution about the company's ability to sustain its growth rate. Researching these projections and understanding the underlying assumptions is crucial for making informed investment decisions.

Duolingo Stock: Risk Factors to Consider

Investing in Duolingo stock, like any investment, involves risks.

- Competition: The language learning market is competitive, with numerous apps and platforms vying for users' attention. Duolingo must continue to innovate and differentiate itself to maintain its market share.

- Monetization Challenges: Converting free users into paying subscribers can be challenging. If Duolingo struggles to monetize its user base effectively, its revenue growth could be limited.

- Dependence on Mobile Platforms: Duolingo primarily operates on mobile devices. Changes in app store policies or user preferences could negatively impact its user acquisition and engagement.

- Economic Downturn: During economic downturns, consumers may cut back on discretionary spending, including subscriptions to language learning apps.

Understanding these risks is essential for assessing the potential downside of investing in Duolingo stock.

Duolingo Stock: Investor Sentiment and Expert Opinions

Investor sentiment towards Duolingo stock can be gauged by analyzing social media discussions, online forums, and news articles. Positive sentiment can drive up the stock price, while negative sentiment can lead to selling pressure.

Expert opinions on Duolingo stock vary. Some analysts are bullish on the company's long-term prospects, citing its strong brand, large user base, and innovative approach to language learning. Others are more cautious, pointing to the company's valuation and competitive landscape.

It's important to consider a range of perspectives and conduct your own research before making any investment decisions. Don't rely solely on the opinions of others.

Duolingo Stock: How to Buy Duolingo Stock

Buying Duolingo stock is a straightforward process. Here's a step-by-step guide:

- Open a Brokerage Account: Choose a reputable online brokerage that offers access to the Nasdaq Stock Market, where Duolingo is listed. Popular options include Fidelity, Charles Schwab, Robinhood, and eToro.

- Fund Your Account: Deposit funds into your brokerage account via bank transfer, debit card, or other accepted methods.

- Search for Duolingo Stock: Use the brokerage's search function to find Duolingo stock by its ticker symbol (DUOL).

- Place Your Order: Enter the number of shares you want to buy and choose your order type (e.g., market order, limit order).

- Review and Confirm: Double-check your order details before submitting it.

Remember that investing in stocks involves risk, and you could lose money on your investment.

Duolingo Stock: Long-Term Investment Strategy

For long-term investors, it's important to consider Duolingo's potential for sustained growth and profitability. Factors to consider include:

- Company's Vision and Strategy: Does Duolingo have a clear vision for the future and a sound strategy for achieving its goals?

- Management Team: Does the company have a capable and experienced management team?

- Competitive Advantages: Does Duolingo have any sustainable competitive advantages that will allow it to maintain its market position over the long term?

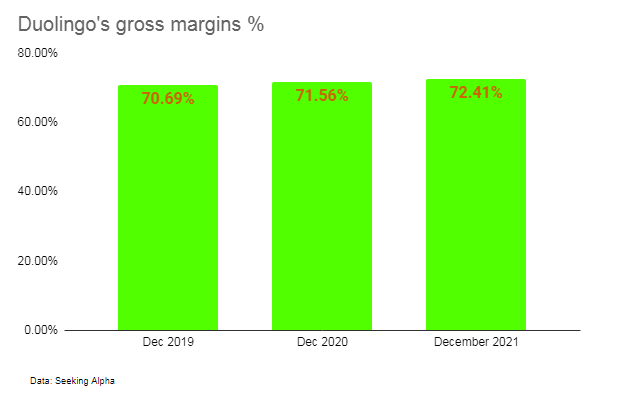

- Financial Health: Is the company financially sound, with a strong balance sheet and healthy cash flow?

Answering these questions will help you assess whether Duolingo is a suitable investment for your long-term portfolio.

Duolingo Stock: Q&A - Your Burning Questions Answered

Q: Is Duolingo Stock a Good Investment for Beginners?

A: It depends on your risk tolerance. Growth stocks like Duolingo can offer high potential returns, but they also come with higher risk. Beginners may want to start with more diversified investments, such as index funds, before investing in individual stocks.

Q: What is the Long-Term Outlook for Duolingo Stock?

A: The long-term outlook is uncertain, but Duolingo has the potential to continue growing its user base and revenue. Its success will depend on its ability to innovate, monetize its platform, and compete effectively.

Q: How Does Duolingo Stock Compare to Other EdTech Companies?

A: Duolingo is unique in its focus on gamified language learning. Comparing its financial performance and growth metrics to other EdTech companies can provide valuable insights.

Q: Should I Buy Duolingo Stock Right Now?

A: That depends on your investment goals, risk tolerance, and due diligence. This article is not financial advice. Always consult with a financial advisor before making any investment decisions.

Keywords: Duolingo Stock, DUOL, Language Learning, Stock Market, Investment, EdTech, User Growth, Monetization, Risk Factors, Investor Sentiment.

Summary Question and Answer: Is Duolingo stock a good investment? It depends on individual risk tolerance and careful consideration of the company's growth potential, risks, and financial health. Conduct thorough research and consult with a financial advisor before investing.

How To Buy Duolingo Stock 2025 Invest In DUOL How To Buy Dualingo Stock 768x512 Duolingo Stock DUOL 2025 Price Quote News And Symbol Duolingo App Duolingo Stock Hits Record High On Impressive Q1 Results News And Duolingo 13570156.webpDuolingo Stock How Duo Captured The Attention Of Students Social Duol Duolingo Stock Analysts See Potential Despite Volatility Stock Sta Stock Chart Widget 12 1 Duolingo Stocks Soaring Should You Jump In Duolingos Stock Surge Sai Driven Expansion Fuels Growths Duolingo Stock Soars Growth Potential In 2023 And 2024 Expert Blog DuolingoStockSo The Selloff In Duolingo Stock Is An Opportunity Maintaining Buy 95029 17441598040525644 Origin

Duolingo Stock A Growth Play Amid Tariff Uncertainty NASDAQ DUOL 59489744 17441297522943199 Origin Duolingo Inc DUOL Stock Forecast Price Prediction 2025 2030 DUOLDuolingo 2025 Company Profile Stock Performance Earnings PitchBook RwgXytdWGJmDDu5jt3rco1uQnLy1719332514878 200x200Assetmark Inc Raises Stock Position In Duolingo Inc NASDAQ DUOL Duolingo Inc Logo 1200x675 Stock Price Forecasts Dell Edison International Duolingo Invezz Duolingo Stock Price 1024x569 Duolingo DUOL Stock Wait For A Better Buying Opportunity Seeking Alpha 49966653 16847389836401923 Can Duolingo Stock NASDAQ DUOL Generate Multi Bagger Returns 18e1da11994654ef829c095632f892afWhy Duolingo DUOL Stock Is Up Almost 50 In 2025 TIKR Com Download 7 1 1200x630.webp

Duolingo New Languages 2025 Fresh Additions Coming Soon Duolingo New Languages 2025 1024x574 Is Duolingo Stock A Buy Sell Or Hold NASDAQ DUOL Seeking Alpha 49782598 16318026830125709 Duolingo Q1 2025 Earnings Call Scheduled For May 1 DUOL Stock News Duol Lg Duolingo Max Vs Super Duolingo Which Plan Is Right For You Master Reset Duolingo Essential Steps 2025 1024x579 Duolingo Stock Tremendous Growth Prospects NASDAQ DUOL Seeking Alpha Saupload FgYSqI Ngn39VSBj4UJYG5f4EuWtC1kCtq2MWAKLpNy7qthWve1ZT2HhXTHOB Ito3oVAe00urzi8scM3P47HI84X1pipAB59vZpn373nm1OyZCmkGcWDb0GSlyk7fDJcWkquBVldGXVGbxQ8PL0Yimqv2 HHsow EftA3HvHtEJ6t58 XPN6zTj5Zu3Zw Duolingo Stock DUOL 2025 Price Quote News And Symbol Duolingo Stock How To Buy Duolingo Stock 2025 Invest In DUOL Duolingo Homepage 1024x559 The Selloff In Duolingo Stock Is An Opportunity Maintaining Buy 95029 17441594058478737

Duolingo Stock Gets Price Target Hike On AI Prospects Investor S Stock Duolingo App 01 Shutt 768x432 Duolingo IPO 7 Things For Potential DUOL Stockholders To Know Duol Stock 1 Scaled Translating Success How Duolingo Stocks Have Rallied 18 June June Duolingo Stock.2e16d0ba.fill 1600x900 Duolingo Stock How I Missed Out And Lessons Learned A Short Duolingo Early Trading Chart Duolingo Stock Surges On Muy Bueno Q1 Results Investor S Business Daily Stock Duolingo MascotIPOday 01 Company 640x360 Here S Why 2025 Could Be A Big Year For AI Stock Duolingo THE BHARAT 7e06d5c323625d8bbd78b1828e3e4272Duolingo 2025 Year In Review Natalia Skye Share Duolingo Statistics

10 Ways To Get XP Fast In Duolingo March 2025 Lingoly Io Duolingo Leagues End Duolingo Stock Price Surged In 2024 Is It Still A Bargain Invezz Duolingo Stock 2048x1136 Duolingo Users And Growth Statistics 2024 SignHouse 63c77c6b8aa5ad26e5463165 Duolingo Revenue