Last update images today Banking On A Budget: Smart Money Moves This Season

This week, let's dive into the world of "Bank" and explore how to make the most of your finances, whatever the season. This guide is for everyone, from Gen Z starting their financial journey to seasoned professionals looking to optimize their investments. We'll cover budgeting, saving, investing, and choosing the right "Bank" options to help you achieve your financial goals.

Understanding "Bank" and Your Financial Needs

Before diving into specific strategies, it's crucial to understand your current financial situation and goals. What are you saving for? A down payment on a house? Retirement? A dream vacation? Defining your goals will help you prioritize your spending and saving. Consider using a budgeting app or spreadsheet to track your income and expenses. This will give you a clear picture of where your money is going and identify areas where you can cut back. Look for "Bank" that offers budgeting tools as part of their service.

Target Audience: This section is relevant to everyone, regardless of age or income level.

The Art of Budgeting with Your "Bank"

Budgeting doesn't have to be restrictive. Think of it as a roadmap to achieving your financial goals. Start by listing all your sources of income and then categorize your expenses into fixed (rent, mortgage, loan payments) and variable (groceries, entertainment, dining out). Identify areas where you can reduce spending, even small changes can add up over time. Many "Bank" now offer mobile apps with budgeting features that automatically categorize transactions and provide insights into your spending habits.

Example: Instead of buying coffee every day, make it at home. Instead of dining out every week, try cooking a new recipe at home.

Actionable Advice: Try the 50/30/20 rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

Saving Strategies with Your "Bank": Building a Financial Cushion

Saving is the cornerstone of financial security. Start by building an emergency fund to cover unexpected expenses. Aim to save 3-6 months' worth of living expenses in a high-yield savings account. Explore different "Bank" accounts to find the best interest rates and features. Consider automating your savings by setting up automatic transfers from your checking account to your savings account each month.

Actionable Advice: Treat your savings like a bill you have to pay each month. Even small, consistent contributions will make a big difference over time. Look for "Bank" that offer automatic transfer options.

Investing with Your "Bank": Growing Your Wealth

Investing can seem daunting, but it's essential for long-term financial growth. Start by learning the basics of investing and understanding different investment options, such as stocks, bonds, and mutual funds. Consider opening a brokerage account and investing in a diversified portfolio that aligns with your risk tolerance and time horizon. Many "Bank" offer investment services and financial advisors who can help you create a personalized investment plan.

Example: Consider investing in a low-cost index fund or ETF that tracks the S&P 500.

Actionable Advice: Start small and gradually increase your investment amount as you become more comfortable. Don't try to time the market. Invest consistently over time. Check if your "Bank" offer free or low-cost investment advisory services.

Choosing the Right "Bank" for Your Needs

Not all banks are created equal. Consider your individual needs and preferences when choosing a "Bank". Do you prioritize convenience? Look for a bank with a large ATM network and user-friendly mobile app. Do you want high interest rates? Consider an online bank or credit union. Compare fees, interest rates, and services offered by different banks before making a decision.

Actionable Advice: Research different "Bank" online and read customer reviews. Consider opening an account at a credit union, which is a not-for-profit financial institution that often offers better interest rates and lower fees than traditional banks.

Protecting Yourself from "Bank" Fraud and Scams

In today's digital age, it's crucial to protect yourself from fraud and scams. Be wary of phishing emails and phone calls asking for your personal information. Regularly monitor your bank accounts and credit reports for any unauthorized activity. Use strong passwords and enable two-factor authentication to protect your accounts. Report any suspected fraud to your "Bank" immediately.

Actionable Advice: Never share your personal information with anyone over the phone or email unless you initiated the contact. Be skeptical of unsolicited offers or requests for money.

The Importance of Financial Literacy and Your "Bank"

Financial literacy is the foundation of sound financial decision-making. Take the time to educate yourself about personal finance topics such as budgeting, saving, investing, and debt management. There are many free resources available online, including websites, blogs, and podcasts. Your "Bank" may also offer financial education resources.

Actionable Advice: Read books and articles on personal finance. Attend free financial literacy workshops or webinars.

Summary Question and Answer:

Q: What's the first step to improving my finances this season? A: Understand your financial situation and goals by tracking your income and expenses.

Q: How can I save more money with my "Bank"? A: Build an emergency fund, automate your savings, and compare interest rates at different "Bank".

Q: How do I choose the right "Bank" for me? A: Consider your individual needs and preferences, compare fees, interest rates, and services offered by different "Bank".

Q: How can I protect myself from "Bank" fraud? A: Be wary of phishing scams, monitor your accounts regularly, use strong passwords, and enable two-factor authentication.

Q: Where can I learn more about personal finance and using my "Bank" wisely? A: Utilize online resources, read books and articles, attend workshops, and check if your "Bank" offers financial education resources.

Keywords: Bank, Banking, Budgeting, Saving, Investing, Financial Literacy, Financial Planning, Money Management, Personal Finance, Fraud Prevention, Credit Union, High-Yield Savings Account, Emergency Fund, Mobile Banking, Best Banks, "Bank" near me.

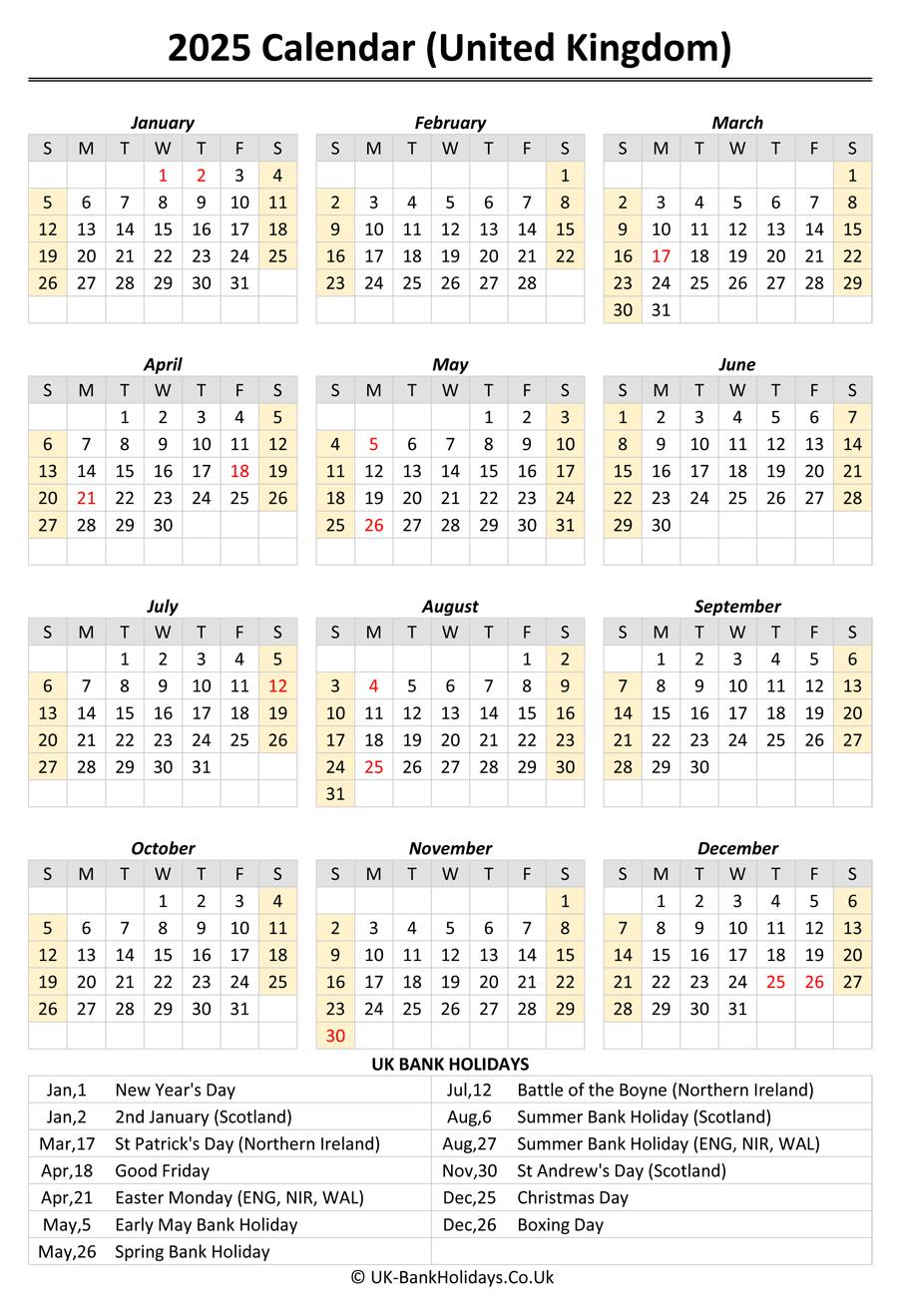

Uk Bank Holidays 2025 2025 Gunner Blake Uk Bank Holidays 2025 Bank Calendar 2025 Pdf Tommy C Boon 2025 Uk Calendar Printable Holidays Portrait Sunday Arah Bauran Kebijakan Bank Indonesia Di 2024 Bisnis Liputan6 Com Ilustrasi BI 2 140722 1 Andri Perspectivas De Los Bancos Espa Oles Para 2025 En Un Entorno De Bajadas Image010 Bank Holidays In 2025 Uk Lindsay Crumb Uk Bank Holidays List For 2025.webp2025 Bank Calendar With Holidays Marvin E Salazar UK Holidays 2025 1200x675 Money In The Bank 2025 Start Time Ophelia Sterlingsa WWE Money In The Bank 2024 Navigating The Year Ahead A Comprehensive Guide To The 2025 Calendar Uk Bank Holidays 2025

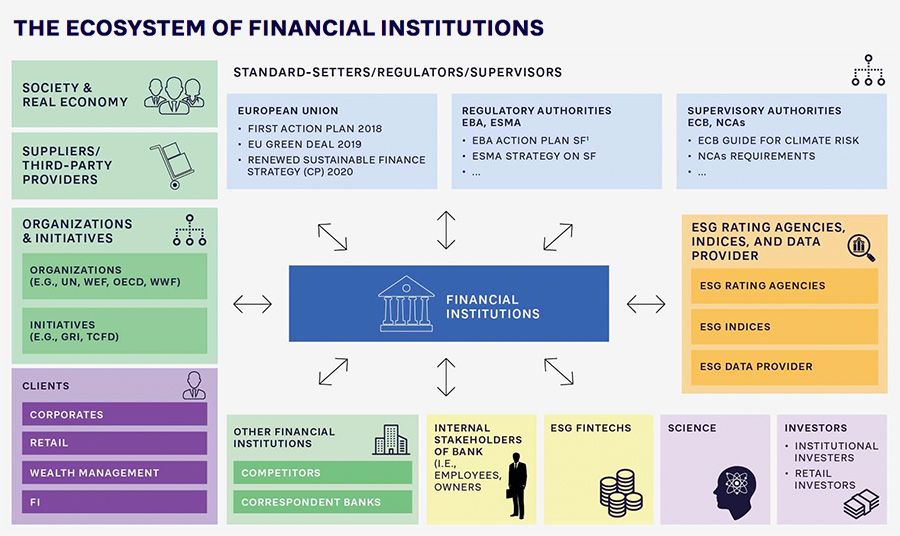

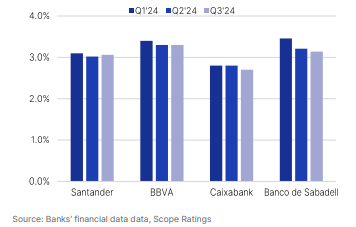

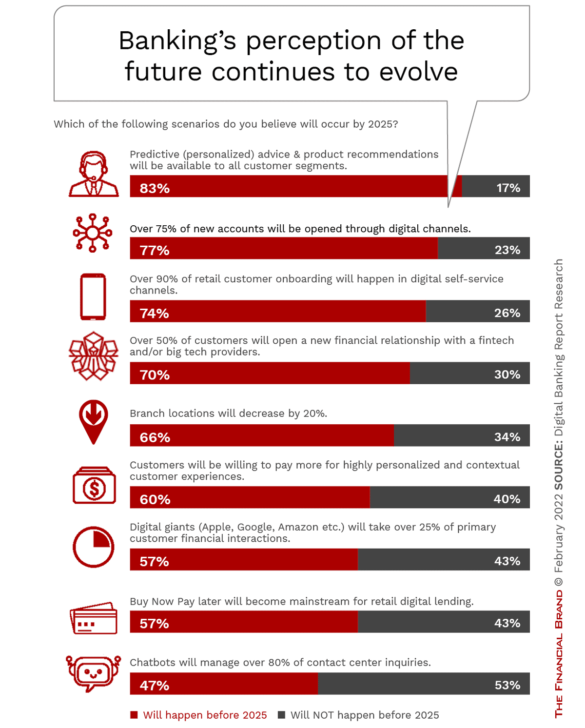

Where Is Money In The Bank 2025 Sam Newman Wp3051029 Bank 2025 Digital Meets Station R ATL00200 Bank 2025 Bank Going Under 2025 Mahsa Emily 2022 07 31 112324268 THE ECOSYSTEM OF FINANCIAL INSTITUTIONS Money In The Bank 2025 Card 2025 Darcy Elsbeth Money In The Bank 2023 Match Card Graphics V0 Chdccy2i2k9b1 The Future Of Banking 2025 Coalition Greenwich The Future Of Banking 2025 Cover T How To Maximise Annual Leave 2025 UK Gov 2025 Calendar Uk With Bank Holidays Scaled.webpLas 10 Principales Tendencias En La Banca Para 2025 El Futuro Est A BANCA 2025 Best Bank To Bank With 2025 Abellona C Damgaard Americas Top 50 Banks And Thrifts 2018 B233

Bank Holidays 2025 Check The List Of Bank Holidays For The Year 2025 Bank Holidays En 2025 BRI Perkuat Digitalisasi Untuk Jadi Most Valuable Banking 2025 IEMZXJlLIJNg3zd1e0D2 1643780069 What Time Is Money In The Bank 2025 Start Betty G Tevis Money In The Bank Logo White Money In The Bank 2025 Highlights Lina Khalil Intro Import Industry Leaders Predict Massive Changes In Banking By 2025 Bankings Perception Of The Future Continues To Evolve REV PSD 585x728 2025 Banking And Capital Markets Outlook PDF Dicfsfsioutlook Bankingcompressed 230818075119 06e6011e Thumbnail What Are The Banking Trends For 2025 AI Cloud And More Trends And Predictions 2025 Banner.webpPDF Banking 2025 The Business Model Bank In The Future Use And Creation Of Deposit Money Q640

Open Banking In 2025 Emerging Trends And Future Forecasts Finezza Blog Open Banking In 2025 Emerging Trends And Future Forecasts Chase Bank 2025 Holidays Amina Pearl Bank Holidays 2024 En Bank 2025 Calendar Edyth Haleigh 2025 Calendar With Uk Bank Holidays At Bottom Landscape Layout Tendencias Que Marcar N El Futuro Del Sector Financiero En 2025 HSB Imagen De WhatsApp 2024 12 18 A Las 12.21.34 93b2bc8e 1 Money In The Bank 2025 Start Time Uk Kourosh Chase WWE MITB 027012 1920x1080 B9e255d399 What Will 2025 Hold For Banking And Financial Services Trends 2025 Auriga Blog ENG CFA Level 2 Question Bank 2025 CFA Level 2 Question Bank 2025 Scaled The 2 New Faces Who Will Decide Interest Rates From 2025 Revealed The Id5728522 GettyImages 1241152005 LS 1080x720

Bank Holiday Calendar 2025 A Comprehensive Guide Calendrier 2025 Bank Holidays 2025 England Wales Money In The Bank 2025 Highlights Lina Khalil Pronostics Wwe Money In The Bank 2024 Best Banks To Bank With 2025 Anna D Masson Banking 1 2

:strip_icc():format(jpeg)/kly-media-production/medias/712414/original/ilustrasi-BI-2-140722-1-andri.jpg)