Last update images today CMCSA Stock: Is Now The Time To Invest

CMCSA Stock: Is Now the Time to Invest?

CMCSA: A Deep Dive into Comcast's Performance and Future Outlook

Comcast (CMCSA) is a media and technology giant with a diverse portfolio spanning broadband, cable, entertainment, and theme parks. Understanding its current standing requires examining recent performance, future strategies, and the competitive landscape. This article provides an informational, educational, and comprehensive overview of CMCSA, going beyond fleeting trends to offer valuable insights. We'll explore key aspects of the company, including its financial health, growth opportunities, and potential challenges, and address the burning question: Is now a good time to invest in CMCSA stock?

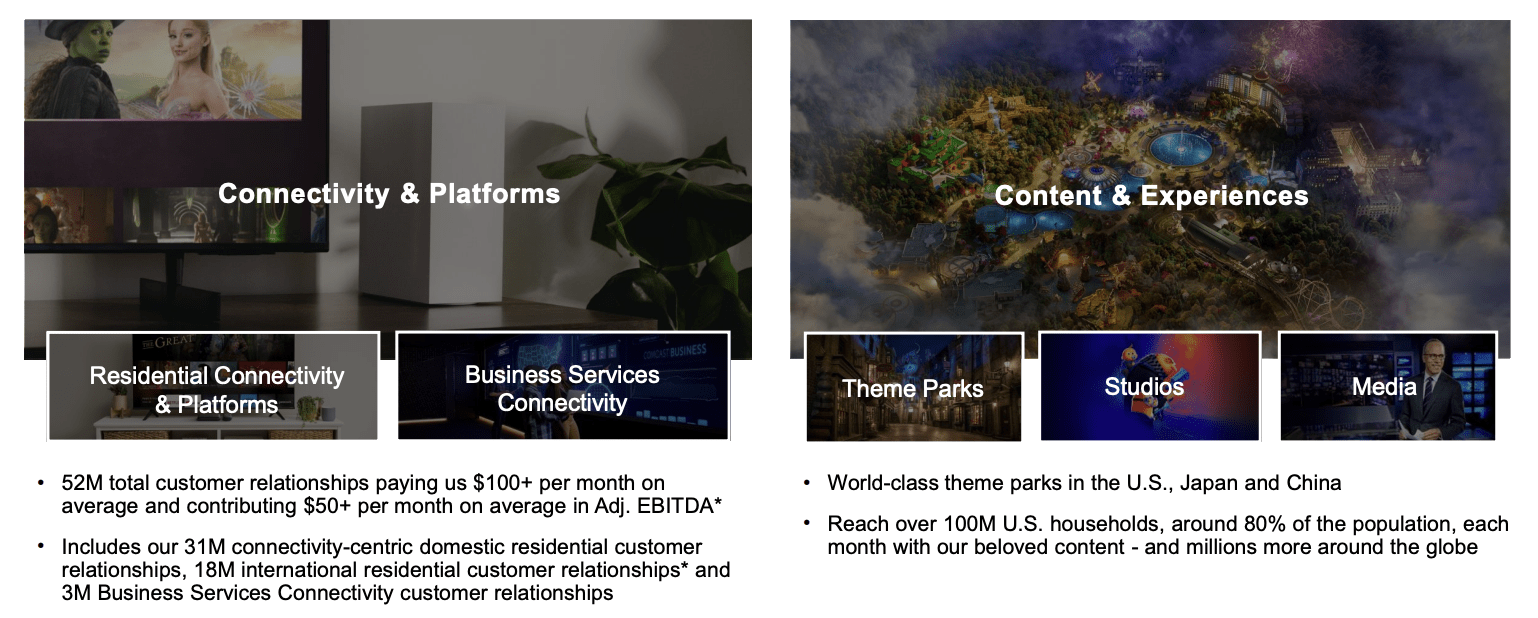

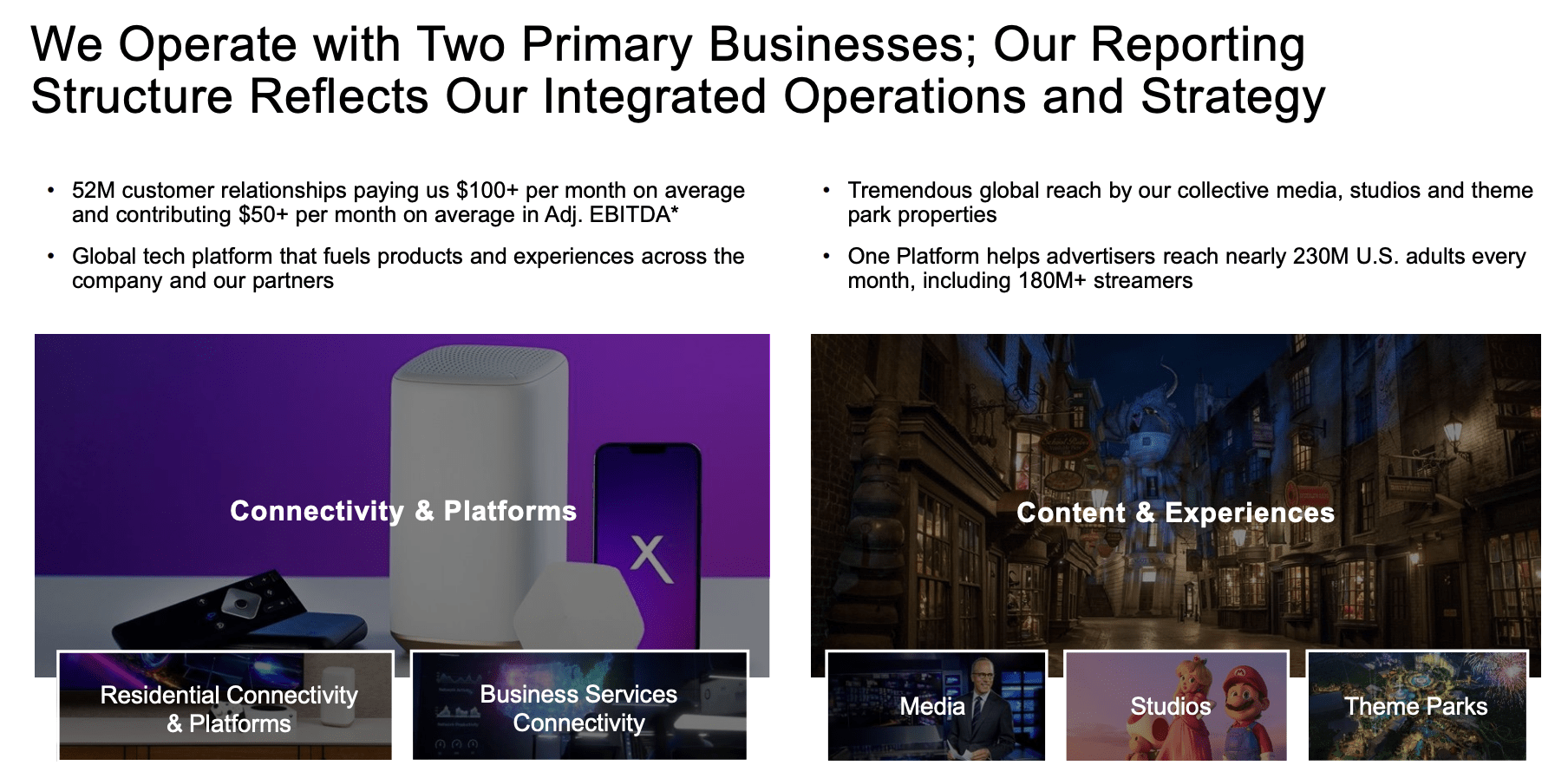

CMCSA: Understanding Comcast's Core Businesses

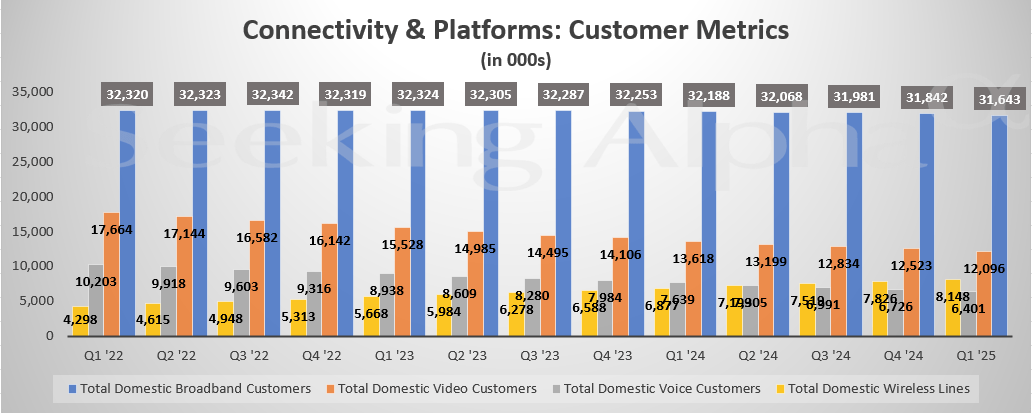

Comcast's success lies in its diversified business model. The largest component remains its cable communications division, providing broadband internet, cable television, and voice services. This segment is a stable revenue generator, albeit facing increasing competition from alternative streaming services and other internet providers. The health of the CMCSA broadband business is crucial to its overall performance.

Another significant arm is NBCUniversal, encompassing television networks like NBC, MSNBC, and CNBC, film studios like Universal Pictures, and theme parks. This division contributes substantially to Comcast's revenue and profitability. Key drivers here are box office performance, television advertising revenue, and theme park attendance. CMCSA's strategic content investments and park expansions are crucial to maintain growth in this segment.

Finally, Comcast owns Sky, a European media and entertainment company. Sky adds an international dimension to Comcast's operations, providing a foothold in the European market. Successfully integrating Sky and leveraging its assets is critical to CMCSA's global ambitions.

CMCSA: Recent Financial Performance and Key Metrics

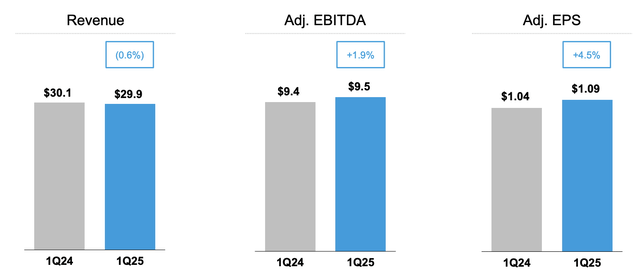

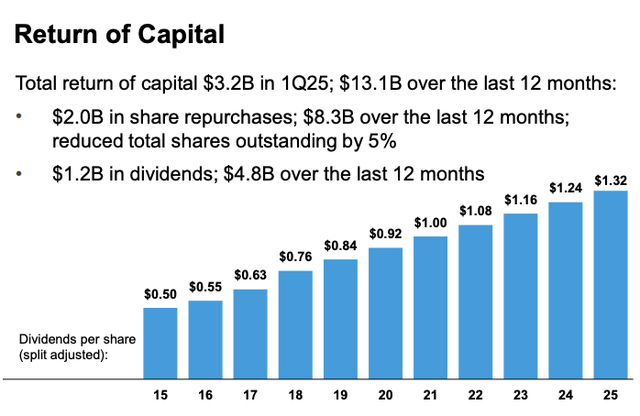

Analyzing CMCSA's recent financial performance provides a clearer picture of its current health. Investors should look at key metrics like revenue growth, earnings per share (EPS), free cash flow, and debt levels. Revenue growth indicates the company's ability to expand its market share, while EPS reflects profitability. Free cash flow demonstrates its capacity to invest in future growth and return capital to shareholders through dividends or stock buybacks. A high debt level can be a concern, especially in a rising interest rate environment.

Recently, Comcast has faced challenges like cord-cutting impacting its cable television subscriptions and slower economic growth affecting advertising revenue. However, its broadband business has shown resilience, and theme park attendance has rebounded. Analyzing the trends in these key performance indicators will help determine if CMCSA is on a path to sustainable growth.

CMCSA: Growth Opportunities and Future Strategies

Despite challenges, CMCSA has significant growth opportunities. Investing in its broadband infrastructure to offer faster speeds and expand its coverage area is crucial. Focusing on improving customer experience and reducing churn is also paramount. The company is actively investing in its Xfinity platform, offering bundled services and innovative features.

In the entertainment segment, creating compelling content is key. Investing in original programming for its streaming service, Peacock, is critical to compete with Netflix, Disney+, and other streaming giants. Expanding its theme park offerings and attracting international visitors also present significant growth potential for CMCSA.

Furthermore, Comcast can explore strategic acquisitions or partnerships to expand its reach and capabilities. For example, partnerships with other technology companies can enhance its broadband offerings or improve its advertising technology. Successfully executing these strategies will be vital for CMCSA's future success.

CMCSA: Potential Risks and Challenges

Investing in CMCSA is not without risks. Competition in the broadband and streaming markets is fierce. Cord-cutting continues to erode cable television subscriptions, and new competitors are constantly emerging. Furthermore, regulatory changes can impact Comcast's business model, particularly concerning net neutrality and broadband access.

Economic downturns can also negatively affect Comcast's performance. Advertising revenue is sensitive to economic conditions, and consumers may cut back on discretionary spending, affecting theme park attendance and streaming subscriptions. Successfully navigating these risks will be crucial for CMCSA to maintain its profitability and growth.

CMCSA: Analysts' Opinions and Stock Valuation

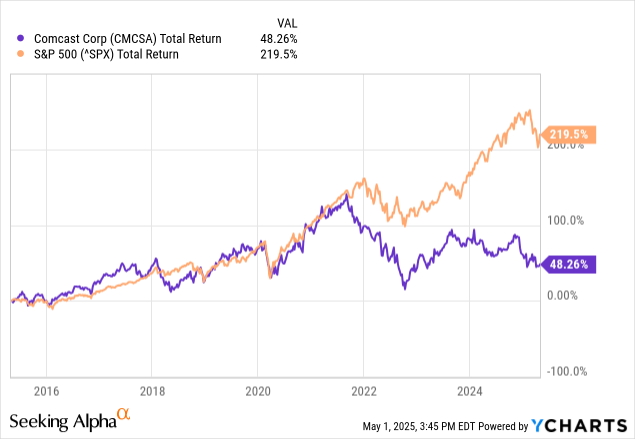

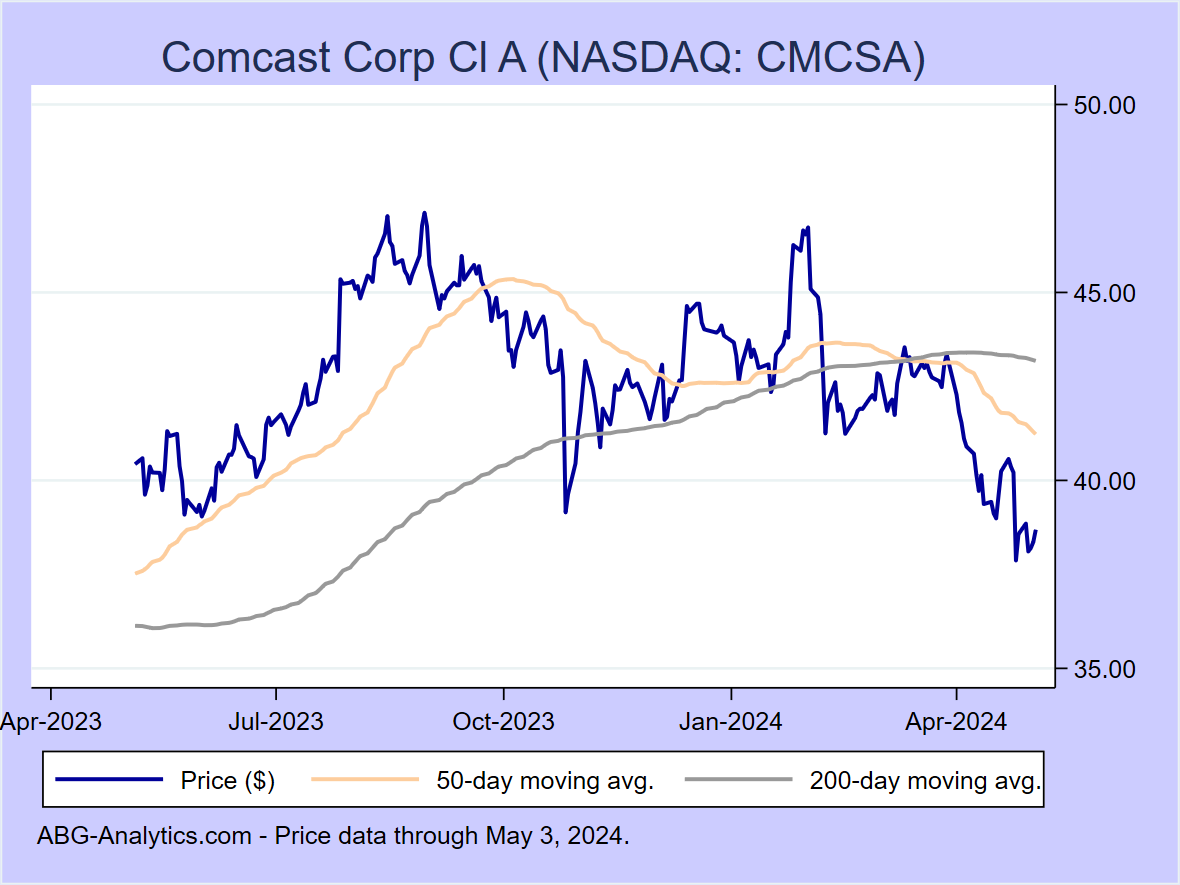

Analyzing analysts' opinions and stock valuation metrics can provide insights into whether CMCSA is currently undervalued or overvalued. Analysts typically issue buy, hold, or sell recommendations based on their assessment of the company's prospects. Examining their price targets can also provide a sense of the potential upside or downside of the stock.

Valuation metrics like the price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and dividend yield can be compared to those of its peers and the broader market to assess whether the stock is attractively priced. However, investors should remember that valuation metrics are just one piece of the puzzle and should not be used in isolation.

CMCSA: The Verdict: Is Now the Time to Invest?

Ultimately, the decision to invest in CMCSA depends on individual investment goals, risk tolerance, and time horizon. While the company faces challenges, it also has significant growth opportunities and a diversified business model.

- Consider Investing If: You believe in Comcast's ability to navigate the changing media landscape, successfully invest in its broadband infrastructure and streaming services, and capitalize on its theme park assets. You are a long-term investor comfortable with potential short-term volatility.

- Reconsider Investing If: You are concerned about the cord-cutting trend, the intense competition in the streaming market, and the potential for regulatory headwinds. You are a risk-averse investor seeking stable returns in the short term.

In conclusion, CMCSA represents a blend of established business and evolving strategy. Thorough research and a clear understanding of its strengths and weaknesses are vital before making an investment decision.

Questions and Answers about CMCSA

Q: What are the main business segments of Comcast (CMCSA)?

A: Comcast's main business segments are Cable Communications (broadband, cable TV, voice services), NBCUniversal (television networks, film studios, theme parks), and Sky (European media and entertainment).

Q: What are some of the challenges facing Comcast?

A: Challenges include cord-cutting affecting cable TV subscriptions, intense competition in the streaming market, potential regulatory changes, and economic downturns impacting advertising revenue and consumer spending.

Q: What are some of the growth opportunities for Comcast?

A: Growth opportunities include investing in broadband infrastructure, creating compelling content for its streaming service Peacock, expanding its theme park offerings, and exploring strategic acquisitions or partnerships.

Q: What should investors consider before investing in CMCSA?

A: Investors should consider their investment goals, risk tolerance, and time horizon. They should also analyze Comcast's financial performance, growth opportunities, potential risks, analysts' opinions, and stock valuation metrics.

Q: Who is a key celebrity associated with NBCUniversal? A: While many celebrities are associated with NBCUniversal due to their involvement in various TV shows, movies, and theme park attractions, Lorne Michaels, is a prominent figure.

Biography of Lorne Michaels: Lorne Michaels (born Lorne David Lipowitz on November 17, 1944) is a Canadian-American television producer and screenwriter best known as the creator and executive producer of the Emmy Award-winning late-night sketch comedy show Saturday Night Live (SNL). He has held this position for most of the show's history since its debut in 1975, taking a brief hiatus from 1980 to 1985. Michaels is regarded as one of the most influential figures in the history of television comedy, having shaped the careers of countless comedians and actors.

Summary Question and Answer: What are CMCSA's main business segments and challenges? The main segments are Cable Communications, NBCUniversal, and Sky, while challenges include cord-cutting and competition in streaming. Keywords: CMCSA, Comcast, Stock Analysis, Investment, Broadband, NBCUniversal, Streaming, Peacock, Cord-Cutting, Xfinity, Sky, Telecommunications, Media Stocks.

Comcast CMCSA Stock Rises 8 On Earnings Beat InvestorPlace Cmcsa Stock 2 2025 6 45 NASDAQ CMCSA R800x0Comcast Stock 2025 Is Full Of Surprises NASDAQ CMCSA Seeking Alpha Saupload F4c04e3ee945506c6cc9aaad6955f5a5 DEME DURDU CMCSA UYGULAMASI LE G NDE 34 DOLAR KAZANMA PARA EK M Maxresdefault Comcast CMCSA Investor Relations Material ImageComcast CMCSA Eyes Turnaround With 5 Year Internet Price Freeze Ahead Cmcsa CMCSA Q4 2024 Earnings Report On 1 30 2025 1 Comcast Corp Class A CMCSA Stock Forecast Price Prediction 2025 CMCSA

Comcast A Telecom Giant Evolving Into A Digital Ecosystem NASDAQ 62444491 17488670891208544 Xfinity Named Official Internet And Mobile Partner Of The Connecticut 0C00000AMP Comcast CMCSA Investor Relations Material Image2025 Could Be An Epic Year For The Theme Park Sector NASDAQ CMCSA Image 183431302 Comcast 2025 Looks Promising But Can The Company Execute CMCSA Image 530183821 Comcast Corporation CMCSA Stock Dividend History Growth 2025 3CMCSA Comcast Corp Stock Price Forecast 2025 2026 2030 To 2050 CMCSA

Comcast Corporation CMCSA Stock Dividend History Growth 2025 3Comcast CMCSA Stock Forecast For 2025 2026 2027 Sell Or Buy Prediction Comcast CMCSA Stock Forecast 768x427 Comcast NASDAQ CMCSA Establishes New Carriage Deal With Paramount Comcast Shutterstock 1472240408 750x406 Why Comcast Corporation CMCSA Is Underperforming In 2025 Compress 1a3f9211f2cbc001 Comcast S CMCSA Expansion Plays Indicate A Promising 2025 AA1qxaiL.imgComcast Corp Cl A NASDAQ CMCSA Stock Report Comcast Corp Cl A NASDAQ CMCSA Stock Chart CMCSA Q1 2025 Earnings Report On 4 24 2025 Marketbeat Logo 1200 1200 Comcast A Telecom Giant Evolving Into A Digital Ecosystem NASDAQ 62444491 17488669998245146

Comcast Stock 2025 Is Full Of Surprises NASDAQ CMCSA Seeking Alpha Image 2198342434 Comcast NASDAQ CMCSA Stock Price News CMCSA Comcast In Charts Domestic Wireless Lines Maintain Steady Growth Q Q Saupload CMCSA2 Comcast A Telecom Giant Evolving Into A Digital Ecosystem NASDAQ 62444491 17488669028973958 Origin Comcast At A Crossroads A Transformation Strategy In A Mature Market 60966524 17434125480961735 Origin Comcast Earnings Free Cash Flow Surges 19 To 5 4B In Q1 2025 CMCSA Cmcsa Lg Comcast Corporation CMCSA Stock Dividend History Growth 2025 3Comcast CMCSA Statistics Alternative Data 2025 CMCSA

CMCSA Q1 2025 Earnings Report On 4 24 2025 Med Generic Stock 0707292461 Comcast SpinCo Leadership Announced For 2025 Launch CMCSA Stock Comcast SpinCo Leadership Announced For 2025 Launch Comcast CMCSA Earnings Date And Reports 2025 1